As the coronavirus continues well into its second year of existence, businesses and individuals are making significant decisions to adjust to today’s sentiments and prepare for the future. These moves range from small (eating out) to large (moving to a less populated area).

MOVING AROUND

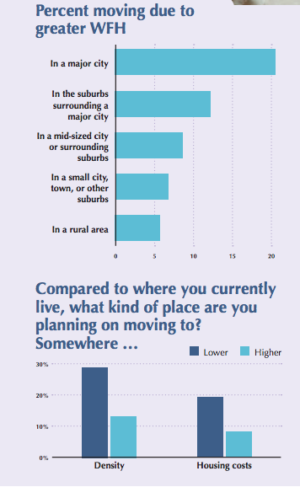

COVID-19, in conjunction with remote work opportunities, is triggering new migration plans for millions of Americans. A recent study by Upwork found that 14 to 23 million Americans are planning to move because of greater work from home (WFH) options—a figure estimated to be three to four times more than normal rates. Between 6.9% and 11.5% of all households are planning a move due to the growing availability of remote work made available by COVID-19.

Cities are seeing the most people moving out as 20.6% of all potential movers currently reside in a major city, reports the survey. More than half (52.5%) are trying to move into a less expensive house and even more (54.7%) are moving more than two hours away from their current residence. Rental markets are experiencing similar trends as the top 10% most expensive markets are seeing a 13% larger decrease in rent prices than markets in the bottom 10%. Ultimately, the most expensive locations have seen the biggest decline in demand, while lower cost of living areas have seen stronger demand.

RESTAURANTS PREPARE FOR 2021

As discussed in previous issues of Club Trends, the restaurant industry has been dramatically changed by the coronavirus. In early December 2020, the National Restaurant Association (NRA) informed Congressional leadership that the industry is in an “economic free fall.” According to the NRA, 17% of establishments (more than 110,000) have closed permanently or long-term. Sixteen percent of these had been open for at least 30 years. In NRA’s November survey of 6,000 restaurant operators and 250 supply chain businesses, 87% of full-service restaurants report an average 36% decline in sales revenue. The outlook does not improve for most eateries as 83% of these restaurants expect sales to be even or worse through February.

Research firm Technomic predicts that in 2021 this market will continue to pivot to find new ways to safely appeal to customers, including:

Menu Cleansing. Restaurants are shifting to fewer menu items and healthier items (immunity boosters, sustainable items like non-dairy milk and reduced emissions items).

Technology Boom. Technology is increasing the ways restaurants can serve patrons. Digital voice assistants, parking lot Wi-Fi, license plate recognition and separate lanes for app orders and delivery are creating more options that cater to customers’ needs and preferences for socially distant service.

Walk the Social Justice Walk. As businesses commit to movements tied to social justice, customers, especially younger, more diverse groups like Gen Z, will demand more transparency from restaurants on these fronts. In response, restaurants will prioritize diversity through their marketing, hiring, leadership and cuisine.

Eatertainment at a Crossroads. Before the pandemic, food halls and eatertainment venues became popular as customers sought fun activities with their dining experience. Some major brands have announced plans to expand or overhaul their services and venues to prioritize COVID-19 safety measures in their models.

Topgolf’s Puttshack has announced plans to move to the U.S. amid the pandemic. The eatertainment venue lets customers play mini-golf games in a fun, restaurant environment. While concerns have arose regarding social distancing and safety, Puttshack requires reservations, staggers mini-golf groups, uses QR codes for ordering, has an outdoor patio, and takes other safety precautions like sanitizing golf balls, disposable menus and staff health screenings.

CONSUMER SENTIMENTS

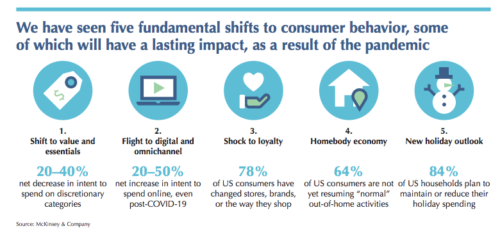

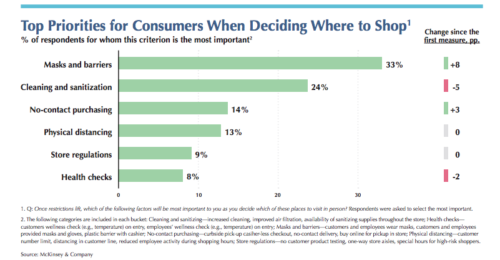

A recent McKinsey & Company survey shows that 75% of U.S. consumers have altered their shopping habits in response to economic pressures, store closings and changing priorities. Additionally, consumers believe the crisis’ impact on their daily lives will extend for more than four months. The survey projected overall spending to rise with the holidays, but discretionary spending to remain negative. Particularly among middle- and lower-class families, holiday spending was forecasted to be lower than previous years. Spending habits are changing elsewhere as consumers are shifting spending to new brands and channels in order to get better value and convenience.

However, while millions of Americans have suffered from a limited economy, savings account balances have grown by $2 trillion, reports economist Ian Shepherdson of Pantheon Macroeconomics, indicating that there is cash available to be spent with an untapped demand for services.

Getting Out There

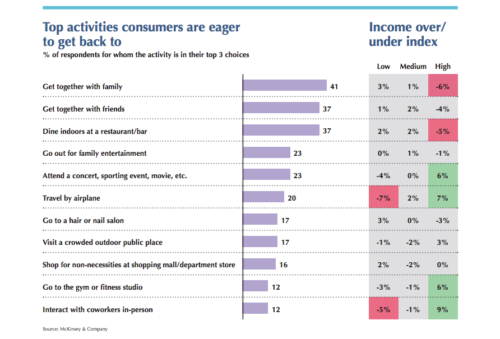

More Americans are engaging in activities now than earlier in the pandemic. Although McKinsey & Company data from October shows that 80% of consumers say they still feel somewhat unsafe, out-of-home activity is increasing with one-third of consumers resuming “normal” out-of-home activities.

Wealth Divide in Sentiment

Consumer confidence fell in November to a three-month low after a new surge in cases caused jurisdictions to restrict businesses, reports MarketWatch. Even though a vaccine will be arriving to millions of Americans, the future expectations index, assessing how Americans view the next six months, fell as well. According to Lynn Franco, senior director of economic indicators at the think tank The Conference Board, consumers forecast that neither the economy nor labor market will gain strength heading into 2021. This sentiment is not necessarily shared by wealthier individuals. Interestingly, a pair of surveys of business executives, who are likely to be high income earners, showed that their confidence in November rose to a five-year high as businesses prepare for a return to normal in 2021, prompted by the vaccine. Additionally, McKinsey & Company data shows that wealthier Americans are more eager to get back to in-person activities than those with less income.

EVOLVING WORKFORCE AND WORKPLACE

Reshuffling

One of the most dramatic economic impacts have been the reshuffling of the workforce. Roughly half of the 22 million American jobs lost early in the pandemic have been recovered as businesses reopened and brought back laid-off workers, reported the Department of Labor in September. Many of these individuals who have found new jobs changed careers altogether. Indicating the shift, from January to October of 2020, Amazon added 400,000 workers, particularly to its e-commerce division. It is not known from where these workers came. A large number of them likely came from the hospitality sector which has been decimated by the virus.

Additionally, an October Harris Poll survey reports that 63% of workers who lost jobs because of the outbreak have changed their industry and 4% have changed their field or overall career path. Being laid off due to COVID-19 was the number one reason for the career change (30%), followed by needing a job that paid more (27%), no growth in current/ old position (26%) and being afraid of being laid off (22%).

The pandemic has significantly impacted low-wage and skill workers who often are unable to transition careers. On a large scale, mismatching jobs and talent could slow the recovery.

Some employers are dealing with skills gaps with increased employee training in adjacent, similar or new skillsets that will allow staff to adapt more easily to a changing work environment. Ricoh, a global printer and copier manufacturer, has adapted by transforming itself into a digital services company. As external forces change the company’s demands, Ricoh partnered with Skillsoft, a digital learning company, to create a more forward-looking and resilient workforce that will be able to perform new roles in the future. In April, PepsiCo launched a learner experience platform that provides articles, podcasts and videos to help ensure their staff have the same career development opportunities as before. Early in the pandemic, these programs included emotional intelligence, parenting tips and other training to build a well-rounded workforce.

New Workforce Demands

The coronavirus exposed many weaknesses and strengths among businesses and their leadership and is expected to pose new challenges and opportunities for them to succeed in 2021. WBT Systems, education consultant for associations, predicts several new workforce trends for the future:

Adaptability. COVID-19 quickly changed the operations and priorities for many businesses. Businesses that can pivot and have the employees to do so can seize new opportunities more quickly.

Leadership Skills. The virus rewarded leaders who can manage in uncertainty. Moving forward, leadership will need to gracefully change quickly and stay creative during crisis. Results Only Work Environment (ROWE). As work goes remote, more businesses will shift to a results-based model for employees rather than hours logged.

Millennials at the Helm. By 2025, millennials will make up 75% of the workforce, occupying more leadership roles and allowing their priorities to influence business practices. Flexibility has been a top goal for many millennial workers. With the onset of mass remote work, it is expected that workplace flexibility is here to stay.

Gen Z Development. Generation Z, those 23 and under, understand the need for development to advance professionally and financially. They desire introductory certification and badges from employers and online education platforms.

Increased HR. As remote work and diversity and inclusion initiatives become more pervasive, increased training for HR and adapting to a remote training program will be more important for employers.

Increased Challenges for Women. As many women are working from home as well as raising children, some forecasters believe they will be nearly twice as likely to leave the workplace than their male counterparts. Employers have an opportunity to address this through sharing responsibilities and better leveraging technology.

Outsourced Workforce. Remote work has become more popular allowing employers to outsource their work and minimize employee benefits. Employers should ensure they properly train outsourced staff to better fulfill their unique duties.

SANDWICHED GENERATIONS

The COVID-19 pandemic has exacerbated familial responsibilities among generations. Many Americans, particular millennials and Gen Xers are finding themselves taking care of both their own children and their parents. As the pandemic continues, these individuals are performing tasks like buying groceries, and running errands to protect their older parents. This group used to consist of middle-aged Americans but is growing increasingly young. Five years ago, millennials made up roughly 20% of family caregivers, reports an AARP study. Today that number is 39%, roughly the same number as Generation X, reports a Morning Consult survey for New York Life.

These responsibilities are pinching pocketbooks for millennials who are also saving money for a house purchase or children. These expenses contribute to less savings, less investments into retirement accounts and more working hours.

WELLNESS GETS REAL

A recent panel at the Global Wellness Summit gathered leading journalists and forecasters to share how the pandemic is shaping the wellness industry for 2021. These trends take a foundational approach to wellness that focus on basic needs opposed to more indulgent forms of wellness. Here are six trends they believe will emerge this year:

Healthcare and Wellness Converge. The coronavirus has exposed the importance of preventative lifestyles, providing a mesh point for health and wellness. Panelist Sandra Ballentine, editor at W magazine, said 2021 will bring a combination of functional and conventional medicine. Cecelia Girr, Senior Strategist at Backslash, commented that integrating health care into wellness will add science-backed credibility to the wellness industry.

Immune Boosts. As discussed in the previous issue of Club Trends, immune boosting products are emerging from food, to supplements and education classes. Genetic testing to identify the best immune therapies for individuals will see more growth.

Removing Taboo from Common Issues. Wellness will shift from emphasizing comfort to core topics often considered taboo in the industry: sex, money and death. Girr forecasted that healthier end-of-life practices, financial therapy and wellness approaches and a new focus on women’s sexual wellness and reproductive health will emerge.

Nature. While COVID-19 has limited people’s ability to see each other, it has incentivized travel tourism and sustainable travel.

Home Wellness. The pandemic has amplified the importance of making home a place for wellness. Products like air purifiers, humidifiers and even wardrobe purifiers, which remove pathogens from clothes are trending up as residents and innovators strive to “pandemic-proof” homes.

In-home and Hygienic Beauty Products. Expect beauty products to focus on antimicrobial and antibacterial benefits, forecasts beauty and wellness consultant Jessica Smith. The self-care beauty trend will grow as consumers look for products they can use in-home, predicts Ballentine. Wellness professionals, nutritionists and personal trainers have new opportunities to grow the in-home experiences with services like virtual classes and digital content.

FITNESS FORECAST

An April 2020 survey of 1,000 fitness club users by investment bank Harrison Co., forecasted that fitness clubs could lose $10 billion annually due to COVID-19.

In response, fitness studios pivoted to virtual offerings as 40% of respondents indicated that they began working out at home for the first time. However, hybrid models have emerged to cater to exercisers’ preferences. Early in the pandemic, roughly 70% of studios offered virtual services but more recently that number has moved to 90%. Still, even as studios reopen, operators expect only 25% to 30% of people to return to in-person classes, with the rest accessing classes digitally, creating opportunities for them to extend their audience past those who can make it into the physical facility.

Marilyn Cox, vice president of marketing at Clubessential Holdings, recommends operators promote registration and check-ins for virtual classes via text or app. Operators can also personalize messages to their customers and prioritize at-risk members to create a connection and keep them engaged.

HOSPITALITY WILL RELY ON TECH

The COVID-19 pandemic has wreaked havoc on the hospitality industry, but leaders are hopeful about the future, especially as technology presents opportunities to make facilities safer and more efficient. Mark Holzberg, President-Americas, CEO at Cloud5 Communications, believes the crisis has accelerated hospitality’s digital transformation and will reward those brands that embrace a digital and physical mix of tools and services that increase efficiency and reduce customer friction. Hotels will use technology to automate work processes and keep better data to understand trends, compare forecasts with results, and track competition, says Datavision Technologies Co-Founder and Vice President Sherry Marek. Touchless features will also be used by hotels to build guest trust and confidence, forecasts Warren Dehan, President of Maestro.

FORECAST FOR 2021

The coronavirus continues to force businesses and consumers to alter every aspect of their lives. However, compared to 2020, this year poses more proactive approaches to respond to the virus, giving new opportunities for effective and thoughtful planning. Clubs should remain mindful of these trends to ensure they stay on the forefront of this crisis.

Club Trends Winter 2021