Crisis Brings Lessons on What it Means to be Member-Centric and Why it Matters

“It’s only when the tide goes out that you discover who’s been swimming naked.” The gist of that famous Warren Buffet quote is that adverse conditions tend to expose the flaws in a company’s strategy or in its overall business model. When the pandemic struck in March, the tide rolled out and revealed a dangerous imbalance in the business models of some clubs. The crux of the issue is revenue mix, and lessons learned through the COVID-19 crisis suggest now is the time for clubs to evaluate, understand and adjust.

If you follow Club Benchmarking education, you’ve heard the emphatic message about the capital ledger being the club’s primary financial driver and the operating ledger being the vehicle for delivering services and amenities to the members. Clubs typically set their operating ledger to break-even and rely on the margin from two streams of revenue to achieve that goal: Dues revenue (100% margin) and nondues revenue from both members and nonmembers (relatively low margin). The key to understanding the imbalance exposed by the pandemic and the threat it poses for your club is in that mix.

Without the aid of the Employee Retention Tax Credit and an adjustment to their operating model, most clubs would have incurred an operating loss in 2020, with clubs that entered the pandemic with an operating model biased towards nondues revenue suffering the greatest losses. The intent of this article is to illustrate the adjustments clubs must make to attain a break-even result from operations, which is critical because losses from operations carry over to the capital ledger. Every dollar lost from operations reduces a club’s available capital, which is in turn used for investment in obligatory capital expenditures (repair and replacement), aspirational capital expenditures, reduction of debt and building capital reserves.

THE SHIFT

After the 2008-2009 recession, declining member counts weakened dues revenue, which put significant stress on operating budgets. Clubs that once proudly offered an exclusive, member-centric private club experience turned to weddings, banquets and outside tournaments (aka nondues revenue) to fill the gap. In addition, many well-intentioned clubs attempted to drive membership growth by eliminating or reducing initiation fees and deferring dues increases—effectively trying to compete on price rather than the value delivered through a compelling member experience. Such decisions manifest very clearly in declining net worth (in real dollars) for half the industry since 2006. It was a dangerous shift away from their true mission—delivering an exceptional experience for their members—and many clubs came to rely on that outside activity to make up for operating shortfalls. In that scenario, the budget begins to dictate strategy, member experience suffers, and it becomes increasingly difficult to generate the money necessary to cover operating expenses.

The immediate consequences of that dependence on margin from nondues revenue came to light in mid-March when the activity that produced it came to a screeching halt. During the last nine months, less obvious repercussions have been revealed through an in-depth analysis of monthly and annual financial data aimed at quantifying the impact of COVID-19 in the club industry. Before diving into the findings of that research, it is important to know two key concepts: Leverage and the difference between dues revenue and margin from nondues revenue.

KEY CONCEPT: LEVERAGE

In business, financial leverage typically refers to the use of debt that is unforgiving and can cause great stress on business models if not used judiciously, particularly in times of adversity. Operating leverage typically refers to a business’s mix of fixed and variable costs. Clubs are high fixed cost businesses. An enterprise with high fixed costs is considered operationally leveraged as incremental revenue above the fixed costs magnifies profits. When revenues shrink in an operationally leveraged business, like clubs, a high degree of fixed costs exposes the business to significant risk of uncontrollable loss.

In the private club industry, where member dues (50%), golf (13%) and food & beverage (32%) comprise about 95% of all revenue, operating leverage relates to the balance in that mix of dues and nondues revenue. While dues revenue is relatively fixed, nondues revenue is variable since it comes from less predictable activity including banquets, golf outings, guest room revenue and à la carte dining.

A club that is overly dependent on margin from nondues revenue to fund club operations is considered operationally leveraged and as such, more vulnerable to sudden setbacks like economic recession, catastrophic weather or the social and economic repercussions of a global pandemic. As many clubs learned this year, relying on marginal profit from variable sales to maintain balance on the operating ledger is a risky and unsustainable proposition.

KEY CONCEPT: DUES REVENUE VS MARGIN FROM NONDUES REVENUE

Clubs cover non-cost-of-goods-sold (COGS) expenses from a combination of two sources: dues revenue and margin from nondues revenue. The margin on dues revenue is 100% because there are no associated direct costs. Nondues revenue, on the other hand, comes at a cost. Nondues revenue covers COGS expense first, with only the margin remaining to cover non-COGS expenses.

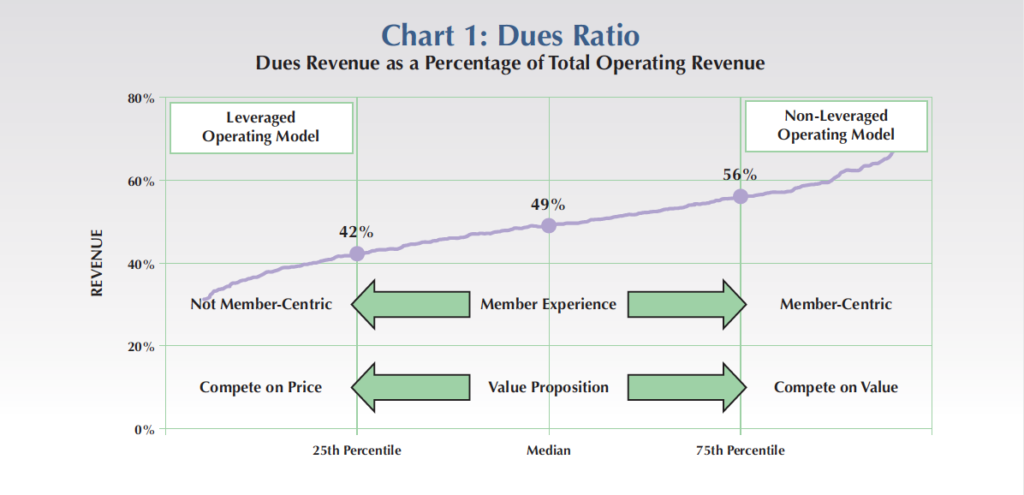

Clubs with nonleveraged operating models are represented on the right side of Chart 1 below.

These member-centric clubs have dues ratios (member dues revenue divided by total operating revenue) greater than 56% and are by definition less reliant on margin from nondues revenue to support the club’s fixed (non-COGS) costs. The quality of the member experience drives these clubs to make strategic decisions. Members have an “owner” mentality and willingly contribute capital for reinvestment in “their” club.

These member-centric clubs have dues ratios (member dues revenue divided by total operating revenue) greater than 56% and are by definition less reliant on margin from nondues revenue to support the club’s fixed (non-COGS) costs. The quality of the member experience drives these clubs to make strategic decisions. Members have an “owner” mentality and willingly contribute capital for reinvestment in “their” club.

Conversely, clubs on the left side of Chart 1 are reliant on margin from nondues revenue to support the club’s fixed costs. The member experience often suffers at these clubs and their members exhibit a “customer” mentality. The focus is often on chasing sources of income other than dues (banquets, golf outings) to support the club, rather than optimal number of members contributing the optimal amount of dues. The common denominator is that clubs are high fixed-cost businesses. Clubs either cover those costs from members or from margin on nondues revenue.

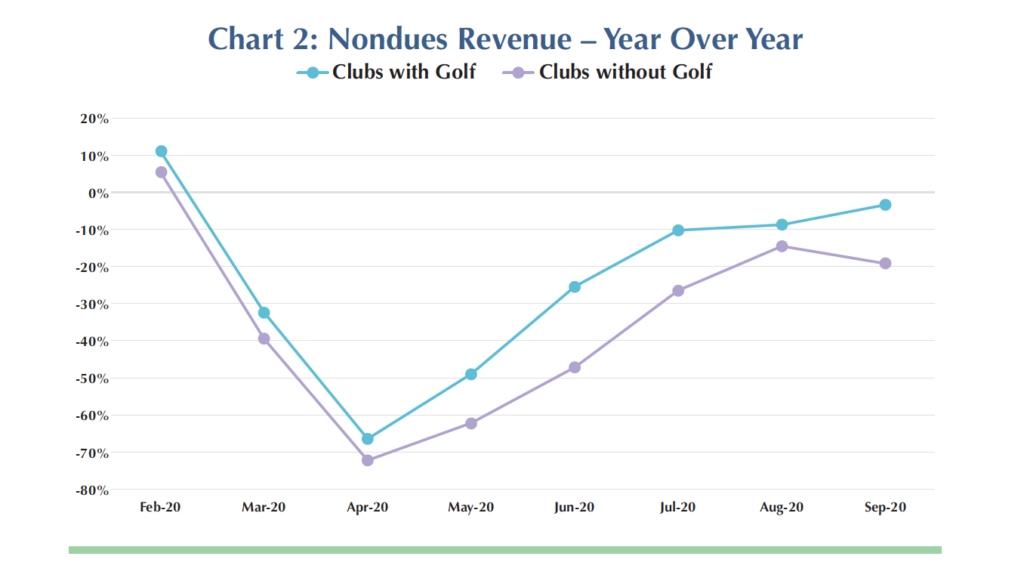

In the earliest months of the pandemic, while dues revenue stayed relatively stable, revenue from golf and food & beverage operations was wiped out virtually overnight. In March, Club Benchmarking reported a decline in year-over year nondues revenue for clubs with golf of 32%. In April, the year-over-year decline was 66%. Clubs without golf saw a decline in nondues revenue of 39% in March and 72% in April. That group, which includes city and athletic clubs, was likely disproportionately affected when members who worked in offices in the city began working from home. Faced with the reality that revenue from activities like banquets and golf outings would be gone for the foreseeable future, most clubs did a quick pivot to focus on delivering as much value as possible to their members, and the data in Chart 2 reflects those efforts. As seen in the chart above, nondues revenue for clubs with golf began a gradual rebound in May that has continued through September despite ongoing restrictions on indoor dining and large gatherings. Those clubs have likely benefitted from the introduction of innovative programming and increased member activity most notably in the form of the immense popularity of golf as a safe, socially distanced outdoor activity. Clubs without golf have not fared as well, with city clubs feeling the most significant impact on nondues revenue.

THE RESEARCH: WHY REVENUE MIX MATTERS

After several years of studying monthly trends in dues and nondues revenue with an intensified focus on that data since early this year, Club Benchmarking undertook a deeper analysis to look for patterns and to understand the significance of the revenue mix as it relates to impact of COVID-19.

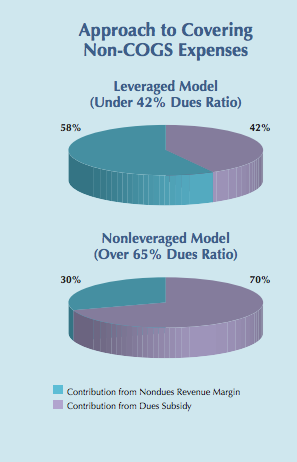

To understand how the amount of leverage in a club’s business model entering the crisis affected outcomes, it is important to look at how clubs approach covering non-COGS expenses on two ends of the dues-ratio spectrum. For clubs in the upper quartile (dues ratio above 56%) the contribution to non-COGS expense coming from nondues revenue margin was 30% with the contribution from dues revenue at 70%. At the opposite end of the spectrum, clubs with a dues ratio below 42%, the contribution from nondues revenue margin was 58% and the contribution from dues was 42%.

Chart 2: Nondues Revenue – Year Over Year Clubs with Golf Clubs without Golf

Chart 2: Nondues Revenue – Year Over Year Clubs with Golf Clubs without Golf

In quantifying the impact of the shutdowns, we focused on losses of margin on nondues revenue associated with delivery of goods and services that fall outside the core member experience, i.e., banquets, weddings, golf outings and guest rooms. For perspective on margin lost during the pandemic, we put it in the context of percentage of full family dues per full member equivalent. At the median, percentage of lost margin per full member equivalent for clubs with a dues ratio above 56% was $725 per full member equivalent, meaning a 6% increase in the full family dues rate is required to achieve break-even net from operations. For clubs with a dues ratio below 42%, the impact was $1,148 per full member equivalent or a 24.2% required dues increase to achieve break-even operations.

TAKEAWAYS: OBVIOUS AND NOT-SO OBVIOUS

What the data shows clearly is that clubs with a dues-centric business model that is focused on the member experience are better positioned to weather this crisis and others in the future because their revenue is more stable and predictable.

Less obvious are the long-term repercussions of a leveraged business model. Over time, an imbalance in the club’s mix of operating revenue is a result of shifting away from a member-centric experience. That spills over onto the capital ledger because the capital ledger is supported by attracting and retaining the optimal number of members. Dues revenue, which by definition is member-centric, will be aligned with capital income from members joining (initiation fee income) and from members belonging (ongoing capital dues and possibly capital assessments). Nondues revenue has very little if any capital income associated with it (i.e., banquets are unlikely to produce sustainable capital income).

It is a strategic and unyielding focus on delivering a compelling member experience that drives both dues revenue and capital income. The member-centric and dues-centric business and financial model are central to clubs driving sustained financial success over time and ultimately growing the club’s net worth over time.

When clubs allow leverage to creep into the business model, the cause may be as simple as having chosen the path of least resistance. Leverage in the form of banquets or golf outings is often an easier “sell” to the members than a dues increase, but the data shows this is not a sustainable position. Recent events present an opportunity to address the issue and make a course correction. Look forward with the vision to develop a compelling member experience that drives a member-centric, dues-centric and capital-centric financial model. Clubs can accept nondues and nonmember revenue, but they shouldn’t build plans around it.

Club Trends Winter 2021