The pandemic has shaped the way we behave as consumers and experts believe the effects may continue for many years. One example, as noted in the macro perspective, is that residential real estate sales are making headlines as consumers flock from large, populated cities to more spacious suburbs, with many electing to move to a new state in the process. This article explores data related to real estate trends and buyer sentiment for private club memberships. The analysis will focus on two distinct types of club communities:

Nonresidential Community Clubs (NRCC) includes gated and nongated communities that may offer lifestyle amenities but do not have a golf component. Community amenities are owned and maintained by an HOA. Residential Community Clubs (RCC) are self contained, private gated communities that offer golf and other lifestyle amenities within the community. Membership may or may not be mandatory.

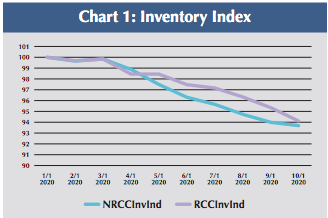

HOUSING INVENTORY

Chart 1 (below) reflects trends in residential real estate inventory since January in nonresidential (blue line) and residential (purple line) club communities in the Southwest Florida market including Naples and Ft. Myers. Trends are indexed to 100 to provide a normalized comparison between NRCC and RCC in this market. The data confirms a shortage of inventory in both community types. In a normally functioning market, inventory fluctuates each month by 2%. In 2020, the inventory fluctuation averaged 6% for NRCC and 5% for RCC in inventory. Since January 1, NRCC inventory is down 43% while RCC inventory is down 37%.

Interpretation: In early summer, the pandemic’s impact was evident on both sides of the real estate equation, with potential sellers reluctant to put their homes on the market and buyers putting plans to move on hold. In June, a survey by Golf Life Navigators found that 79% of first-time club buyers in the Sunbelt planned to delay their search, citing COVID-19 and related economic uncertainty as the primary cause. In addition, 85% of multi-club buyers (those with at least one other membership already) delayed their search for the same reasons. With inventory tight, home prices climbed and stories circulated about consumers buying Sunbelt homes sight-unseen.

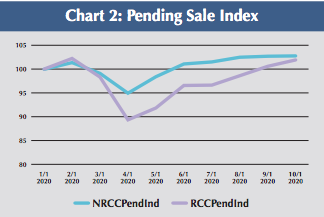

PENDING SALES

In Chart 2 (below), a drop in pending sales in both categories in April was followed by a steady increase through November. Since July, the gap in pending sales has tightened with RCC outpacing sales in NRCC.

Interpretation: In October, Golf Life Navigators repeated their survey and a number of positive trends appeared that are supported by Club Benchmarking real estate data.

1. The number of first-time club buyers postponing their search has declined 15% since June. Only 71% of multiclub buyers are keeping their search on pause, down 14% from June.

2. Among buyers interested in living in a gated club community, 64% said they were now actively focused on purchasing a home—up 13% since June. The shift in sentiment suggests buyers are putting more value on safety, secure/controlled environments and the ability to be “in a bubble” with amenities available should another pandemic occur. “Golf and tennis are definitely on the rise, and living in a safe environment is the key to the buyers motivation,” said Tim Bakels, CCM, CCE, general manager/COO of Colleton River Club in Bluffton, S.C.

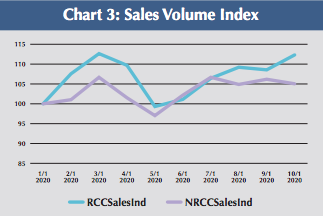

SALES VOLUME

Chart 3 (below), shows changes in sales volume between the two community types. Since May, there is a steady increase in sales with RCC sales outpacing NRCC sales. Looking at pending sales as a leading indicator, we expect the trend to continue.

“Despite being closed for three months, we are having the second-best year in the past 12 years,” said John Jorritsma, director of sales and marketing for The Club at Ibis in West Palm Beach, Fla. “Buyers fear a long winter lockdown and feel safer outdoors which is evident in the increased activity of all our outdoor activities. F&B activity has also increased due to the convenience of ‘order-to-go meals.’”

On the west coast, Jeff Dekruif, assistant general manager and CFO of Blackhawk Country Club in Danville, Calif., reports similar results: “Demand for Blackhawk real estate has surged in response to the pandemic. Closed transactions are up 27% in 2020 with nearly a third of the year-to-date sales closed in September. We are experiencing a tremendous increase in demand from families looking to escape the hustle and bustle of San Francisco.”

Says Dekruif, “They’re drawn by the safe, gated lifestyle community with its own police substation, great schools, two championship golf courses, the largest tennis complex in Northern California, a state-of-the-art sports complex, and direct hiking access to Mt. Diablo. With seven food & beverage outlets, our residents know they don’t have to leave the gates to enjoy quality experiences.”

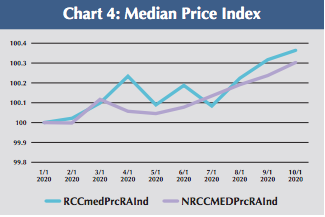

MEDIAN PRICE

Chart 4 (below) reflects changes in median price for both community types. Prices are rising due to high demand, limited inventory and the appeal of the South Florida market. The pricing index between the two community types has accelerated since July, with RCC pricing growing at a faster pace.

Interpretation: It’s a seller’s market for homes in residential club communities. Golf Life Navigators’ October data shows an increase in buyers combining their club and home search—up to 72% of all buyers in the marketplace. In addition, 88% of buyers plan to play more golf in the future (up 11% since June) and 38% of buyers plan to expedite their search/purchase, citing the following factors: low interest rates, growing market demand of club community homes, escaping large northern cities, moving to a tax-friendly state, and the ability to work remotely. “Between the dynamics of our recently completed golf course and clubhouse renovations and consumers’ motivations to move up their second home club and real estate decision, we have flourished,” said Bob Radunz, general manager/COO of The Quarry Golf Club in Naples. “Club memberships and real estate sales are up, and we have increased our initiation fees with no resistance.”

LOOKING AHEAD

2020 taught us a harsh lesson about predictions, but the data is compelling, and we are optimistic that the trends will continue into 2021. Clubs that fit the RCC or NRCC model should keep a close eye on the local real estate market, paying special attention to the condition of homes being sold in their community. Club leadership teams have an opportunity to focus on creating a value proposition that will capture and hold the attention of a new generation of members and residents.

Club Trends Winter 2021