Many clubs nationwide have enjoyed the benefits of a post-pandemic world, including increased club activity and long waitlists to join. They expect a positive 2024–at least, those that continue to evolve and address its challenges.

Positive Economic Signs

Another year removed from the COVID-19 pandemic and general economic uncertainty, financial publisher Kiplinger expects another year of growth for the U.S. economy. Here are several of its 2024 forecasts:

- The economy will avoid recession. While concerns for recession persisted throughout 2023 and rear its head in our Pulse Survey results (page 7) for 2024, the economy outpaced expectations last year and is forecasted to grow again this year. However, growth is expected to slow from 2.5% growth in 2023 to 1.7% in 2024.

- Inflation (mostly) reined in. Kiplinger expects inflation to decrease to 2% before the end of summer before rising to 2.7% by year’s end. Lower inflation is expected to bring lower interest rates.

- The housing market won’t rebound. While lower rates may help drive sales, home prices are not expected to fall.

- Staffing concerns remain. 40% of small businesses said they have openings they can’t fill; however, there have been some improvements in being able to hire new employees.

- Global perspective. The global economy is expected to slowly grow. In the positive, supply chains are largely repaired and food and energy prices are decreasing.

An Unkind Hospitality Labor Market

Workers quitting, regardless of job sector, has slowed since Great Recession highs in 2021 and 2022, sitting at 3.7% as of September 2023 and returning to levels seen prior to COVID-19. However, the hospitality and leisure industry quit rate ranks highest among all sectors at 4.1%, and still outpaces pre-pandemic levels, reports the Job Opening and Labor Turnover Survey by Indeed. Hospital- ity workers are still in high demand as only six in 10 job openings are getting filled, per the U.S. Chamber of Commerce.

Some Solutions

Conveying a larger purpose. The historic LaFayette Hotel and Club in San Diego hired 140 workers in a short period to unveil its newly restored facilities, attacking all avenues to get younger workers. Their message? Make the hotel and club an amenity and attraction, not just for guests, but for all the city. Conveying bigger purposes is particularly attractive among Gen Z, born 1997-2012.

Embracing technology. COVID-19-era solutions like self- service kiosks, mobile entry and leaner staff rolls helped the hospitality industry manage worker shortages and now appear to be here for the long-term. Major hotels have opted for more advanced technology like robotic bartenders that dispense mixed cocktails to patrons. Adding personality and humor to these machines, Marriott’s International Renaissance in Las Vegas named its robots Elvis and Priscilla.

Human impact. Despite the solutions this technology provides, the human impact has been felt as workers see their numbers reduced and tasks increased. While advanced devices like robotic bartenders offer some relief for employers, they still require maintenance and oversight to fix clogs and fulfill other drink orders, putting more responsibility on the reduced staff. In Nevada, the Culinary Workers Union, the state’s largest union, organized a strike, partially in protest of these and other cost-saving measures.

The service robots industry is projected to reach $216 billion by 2030.

Source: GlobalData.

800 million jobs may be automated by 2030.

Source: McKinsey Global Institute

Club Question: Would your club use machines to help solve staffing issues?

Consumer Entertainment Trends

A recent study by marketing firm LaneTerralever and the International Association of Amusement Parks and Attractions surveyed consumers on their interest in going to in-person attractions this year includ- ing theme parks, destinations and other live entertainment events. Here are the results:

- 93% of all respondents said they are planning to visit the same amount or more attractions in 2024 compared to 2023.

- 50% of Gen Z and affluent visitors planned to visit more attractions in 2024, the highest of any group.

- Affluent visitors were 2.4x more interested in traveling and going to pop-up exhibits.

- Affluents were 2.5x more interested in interactive exhibits than other demographics.

Marketing

- Social media was the top driver for young millennials (48%) and Gen Z (52%) for visiting local attractions.

- Word of mouth was the top driver for older local visitors (68% baby boomers, 56% Gen X).

Values

- 80% of visitors said they are more likely to be loyal to an attraction brand whose purpose or mission is aligned with their values. However, Gen X and boomers consider this a “nice to have” and not a necessity.

- 48% were more willing to pay more to visit an attraction that has a strong commitment to sustainability.

- 80% of Gen Z said that sustainability is a key driver.

Education Component is Key

61% of education attraction visitors have kids in their households.

75% of education attraction visits went to interactive/ immersive experiences.

61% of visitors are affluent.

Forgive not Forget

87% of visitors will give an attraction at least one chance to fix a bad experience.

Boomers are least likely to forgive and forget a bad experience.

Study: How Attractions & Entertainment Destinations Must Adapt to the Visitors of Today & Tomorrow, LaneTerralever, International Association of Amusement Parks and Attractions

Club Question: Clubs are perfect venues for live entertainment and events. What can your club do to capitalize on these trends?

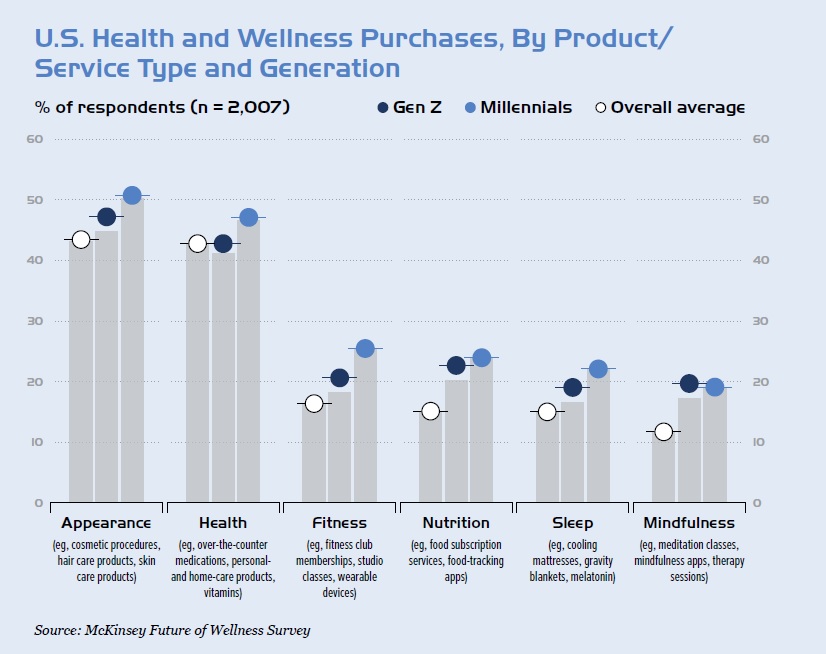

Wellness Trends

The wellness industry is expected to grow as the population ages and more people become aware of their own health and healthy best practices. In the U.S. alone, this market is valued around $480 billion, growing 5-10% annually. Eighty-two percent of U.S. consumers now consider wellness a top or important priority in their everyday lives.

Trusted Sources.

More consumers shifted wellness product preferences from ones with clean or natural ingre- dients to those with clinically proven ingredients.

Consumers favor clinically-backed products in areas like over-the-counter products, vitamins and supplements, beauty products and more.

In the era of “healthwashing,” using deceptive marketing to showcase products as healthier than they really are, more consumers are expected to rely on doctor recommendations for their health and wellness purchases.

Source: McKinsey Future of Wellness Survey

- Healthy aging. More than 60% of respondents said it is “very” or “extremely” important to purchase products or services that help with aging and longevity. Note: These feelings were true for consumers among all age groups.

- Weight management. 60% of respondents said they are currently trying to lose weight.

- 50% of consumers considered prescription medication to help lose weight.

- In-person fitness. Roughly 50% of gymgoers said fitness is a core part of their identity.

- 60% said they always make time to exercise.

- 45% said they are in better shape than most people they know.

- Gut health. 80% of consumers said they consider gut health to be important.

- More than 50% anticipate making it a higher priority in the next two-to-three years.

- Sleep. 37% of U.S. consumers said they want additional sleep and mindfulness products that address areas such as cognition, stress and anxiety management.

Top two areas where consumers are expected to spend more in 2024

In-person fitness classes

Personal training