As “life as normal” continues to change meaning since the pandemic’s onset, so do the trends that shape how individuals behave and make decisions. The last two years have put many plans on hold while rapidly introducing new ways to approach daily routines, whether via new work structures, entertainment sources or lifestyle options. Particularly divided are generations whose differences in many ways are more distinct than before. This article discusses many of these changes and how brands and employers may need to adapt in 2022 and beyond.

THE NEW WORKPLACE LANDSCAPE

The labor force and workplace were upended by the pandemic, reshaping the work environment. In early 2022, the job market has favored prospective employees who want to change careers or increase their pay. Specifically, resignation rates for employees between the ages of 30 and 45 increased 20% between 2020 and 2021—more than for any other age group, according to a study by Harvard Business Review. As a result, employers have changed their practices to recruit and retain the best talent.

Hospitality Focuses on Employees

The hospitality industry, particularly the hotel segment, has struggled to stay fully staffed the past two years. One side effect of the early pandemic hiatus is that more workers expect better work-life balance, reports HOTELS. Management company Aimbridge Hotels has added a new way to prioritize employees’ time by scheduling around their work availability. Aimbridge also now hires more part-time workers and creates utility positions for individuals who are cross-trained for multiple roles across the hotel. Pay and benefits are negotiable and the company has added perks like free parking and meals to stay competitive. Aimbridge has adjusted practices when employees are sick as well.

Instead of continuing with normal services, the hotel may reduce some services by turning down potential reservations to reduce staff burnout. Department heads and general managers at the hotels have pitched in as a symbolic and practical gesture to show that the entire staff is on the same team.

Workplace Values

Millennials now make up the largest cohort of the workforce and their younger counterparts, Gen Z, have begun to enter the workforce as well, shifting the expectations workers historically have for their jobs. Demographics expert Sarah Sladek noted the societal changes sparking from 2020 events have served as a catalyst for new expectations that employers should take into account to create a true sense of belonging at work. Sladek offered four employer priorities to create this environment:

- Listen – Strive to understand the perspectives of young professionals. Their needs could be very different than those of established professionals.

- Create solutions – Prioritize generating new and creative ideas. Diversity of thought and collaboration can lead to innovation and team building across the work community.

- Encourage feedback – Create an environment where the entire staff feels they can positively impact the workplace.

- Prioritize – As workers under 40 continue to join the workforce, their perspectives should be represented for major decisions throughout the organization.

It is important to note, however, that these ideals are beholden to workers of all demographics, not solely millenni- als and Gen Z, said Robert Dodds, managing partner of MG Consulting, an IT consulting firm. All generations look for opportunities to grow, receive fair treatment, have flexibility and feel they can make a difference.

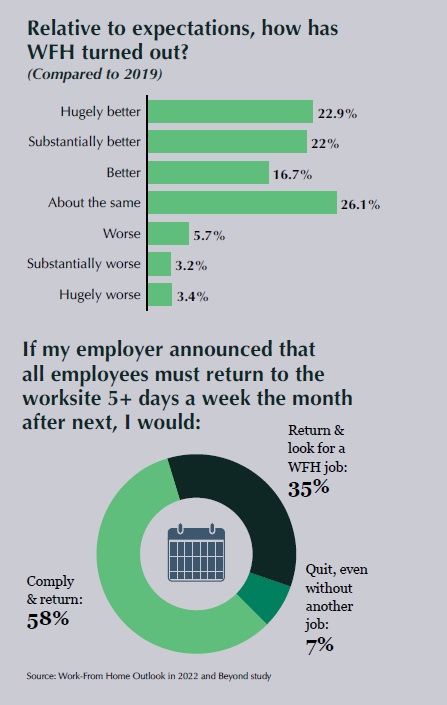

Work From Home

The Work From Home Outlook in 2022 and Beyond study, produced in conjunction with support from MIT, Stanford and other education leaders, found several key pieces of data indicating that working from home (WFH) is likely here to stay. According to the study, WFH will account for nearly 28% of full-paid working days after the end of the pandemic.

SHOPPERS’ SHIFTING PRIORITIES

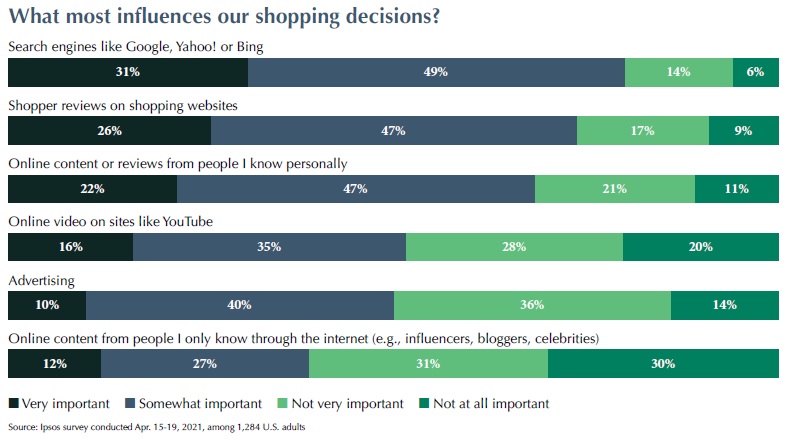

Digitization has increasingly permeated consumer habits. Fifty-five percent of Americans expected to shop online more in 2021 than 2020, reports Ipsos, but younger shoppers lead the way in this area.

Among surveyed adults ages 18-34, 66% said they expected to shop online more compared to just 16% who said they would shop online less.

For those ages 35-54, 59% said they expected to buy more and only 12% said less, and for adults over 55 years, only 42% said they would buy more and 20% said less.

Additionally, 65% of Americans are buying directly on or discovering products through social media. Personal connections are still important in making purchasing decisions, and for 40% of Americans, the top influence in buying a product on social media was a recommendation by a trusted friend.

Added Enjoyment

Consumers want enjoyment in all aspects of life to escape daily boredom and worries, reports Mintel’s 2022 Consumer Trends Survey. This finding is particularly relevant to private clubs. Leading brands will provide not only products, but the feeling of enjoyment with their offerings. Tactics to accomplish this can come in a variety of ways. In the U.K., liquor company Hendrick’s Gin has added greenery, including roses and cucumbers, to emit pleasurable scents at bus stops. Peloton has plans to launch an in-app game that makes users adjust their pedaling speed and resistance to accomplish various goals. Alibaba’s Taobao Maker Festival showcases the latest innovations in China. Recently, the festival created a massive scavenger hunt where visitors will be divided into two teams to hunt for “lost treasure.”

Marketing that Builds Connections

Mintel studies show that consumers are seeking brands they trust on a personal level. In response, brands should assure patrons that their data is safe with easy and clear opt-out options and features that allow them to control their privacy. As clubs remain a strong target of cyber criminals, it is critical they follow best practices to keep members’ minds at ease.

Along with new work styles and priorities for free time, the pandemic has also added increased stress for many Americans. Mintel suggests that messaging should empha- size positive ideas to uplift consumers and allow them to escape negativity. As discussed earlier, these brands should anticipate needs for fun and novelty by providing entertain- ing experiences in a variety of ways, including new and interesting foods, activities and events.

Globally, more consumers are embracing ethical brands as well, reports Mintel. Two-thirds of U.S. consumers who ordered from a restaurant believe the creation of diversity, equity and inclusion initiatives for restaurants is important. Sixty-one percent of U.K. consumers agree that buying from

ethical brands is a good way to benefit the planet. The study stresses the need to use metrics to demonstrate the effective- ness of ethical efforts to help consumers measure the impact of what the brand has achieved.

ENTERTAINMENT EVOLVED

Entertainment has become increasingly personalized and monetized with the advent of technologies like the internet and cell phones, and more recently, the rise of online shopping, virtual spaces, collectibles like non-fungible tokens (NFTs) and streaming services.

Luxury Shoppers Like Tech

While it can be construed that the luxury shoppers may be older and less tech savvy, data shows that those in the luxury market are more open to technology than other groups of

buyers. The Ipsos survey revealed that luxury shoppers are more likely than the average shopper to use an app to try a product. Just 52% of all shoppers are willing to take a virtual test drive through an app, but 70% of shoppers who purchase three or more luxury items are willing to do the same. Luxury shoppers are also more likely (80%) to use an app to try on glasses than all other shoppers (65%), and they’re more likely to try on clothes virtually (73%) than the average shopper (54%). More than a quarter (29%) of luxury shoppers consider themselves very or extremely familiar with NFTs, online collectibles based in the blockchain, representing the largest percentage of individuals compared to those making more than $100,000 annually (18%) and those making between $50,000 and $100,000 (10%).

In-home Entertainment

The home continues to provide more compelling sources of entertainment that may lead consumers to prefer staying home instead of going out. A recent Ipsos Coronavirus Consumer Tracker survey revealed that 47% of adults would rather watch a new film release at home instead of going in-person to a movie theater, even if both options were equally safe. The survey also found that 87% of users who subscribed to a new streaming platform during the pandemic say they will keep the service after pandemic restrictions have lifted.

Many parents have begun to see this shift first-hand with their children. Almost half (48%) of those with children at home have three to five video streaming subscriptions, compared to 31% of households with no children. Twenty- two percent of parents say their children spend 10 hours or more weekly on screens during their free time.

Emerging Realities

The pandemic has expedited the development of augmented reality to share near real-life experiences virtually. Augmented reality has opened doors to marketing teams and brands to share their products and services in an entirely new way. These virtual spaces make up the metaverse, a network of 3D virtual worlds that connect people to each other. In the metaverse, users can buy virtual and physical goods, play games, interact with one another, buy real estate, start businesses, and do much more. While in its infancy, companies that sell physical products, like Walmart, Adidas and Balenciaga, are already making significant investments into the metaverse to become first movers and get footholds in this emerging space, reports Forbes. Goldman Sachs has called the metaverse an “$8 trillion market opportunity.”

Younger consumers have quickly embraced virtual spaces through gaming and other activities, but brands like the gaming company Roblox have already begun to develop features for older consumers, said Roblox CBO Craig Donato. The company has developed a virtual version of its head-

quarters to host staff gatherings, with features that include whiteboards and conference rooms. Virtual concerts have also begun drawing thousands of attendees.

Though full adoption seems far away, many Americans already regularly interact with the virtual world, whether through 3D tours (read “Digital Twins: Immersive 3D Brings The Club Home” in the spring 2021 issue of Club Trends), testing and buying products, and communicating with one another. Developments like virtual reality, online buying and the emerging metaverse provide a critical opportunity for clubs to embrace their value proposition to offer the best real—and perhaps eventual virtual—experiences for mem- bers to enjoy each other’s company.

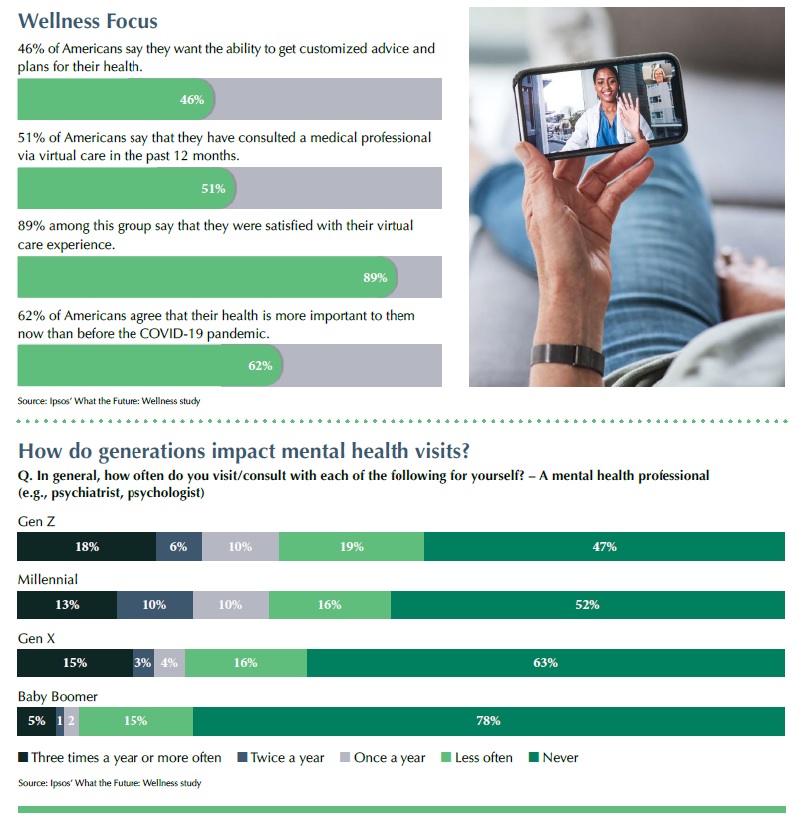

EMOTIONAL CHECK-IN

The pandemic has worn on many Americans emotionally, reports a December 2021 survey from the World Health Organization. Sixty percent of respondents claimed they are “worn out” by COVID-19 related changes. However, most Americans are still optimistic about their prospects, reports a recent Harris Poll from the American Psychological Associa- tion. The survey found that 70% of adults were confident their situation will be okay after the pandemic ends and 77% said they are faring well. That said, daily tasks and decision- making have become more challenging for some demograph- ics. Almost half (48%) of millennials say that stress from the coronavirus has hampered their ability to make basic decisions like what to wear and where to eat. Thirty-seven percent of Gen Z felt the same way compared to just 32% of Gen Xers, 14% of baby boomers and 3% of older adults.

And despite the general optimism from those surveyed, 53% agreed that they are struggling through the pandemic. Those with annual household incomes of less than $50,000 reported having the lowest levels of resilience. The study also found that decision-making fatigue has a stronger effect on parents, especially those with younger children. Parents with children under age 18 were more

likely than those without to say that both daily and major decisions are most stressful today than before the pandemic. Much of this can be attributed to changes to work, school and daily routines.

Pandemic stress is higher among people of color, particularly Hispanic adults. Sixty-eight percent of Hispanic adults and 72% of Black adults said they were faring well during the pandemic, vs. 81 percent of non-Hispanic white adults. The survey attributes racial and ethnic disparities in relation to the pandemic’s impact as reasons for increased stress among Hispanics. Specifically, more Hispanic adults knew someone who had been sick with or died from COVID-19.

OPPORTUNITIES AND CHALLENGES

Many of today’s changing demographic trends challenge brands to adapt in significant ways. However, they also pose opportuni- ties to meet consumers in a personalized way, which clubs have done since their inception. By monitoring the preferences of current and future members, clubs can continue to adapt to provide valuable services and amenities for years to come