The Florida Yacht Club (FYC) in Jacksonville, Fla., was founded in 1876 by New York business- man William B. Astor Jr., with the purpose of promoting yachting and social enjoyment.

Jacksonville—accessible by rail and water, site of grand hotels and known for its pleasant weather—was a winter haven for affluent families of businessmen whose fortunes were bolstered during the Industrial Revolution. The first clubhouse, located in downtown Jacksonville, burned down in the Great Fire of 1901—one of the worst disasters in Florida history and the third largest urban fire in the United States.

After a brief stint in a temporary location, the club pressed on. FYC relocated to a generous parcel of creek-front property until it eventually outgrew that site. In 1928, FYC welcomed members to the handsome Mediterranean Revival-style clubhouse that is its current home. Truly a hidden jewel in Northeast Florida, the campus is tucked away in a beautiful waterfront location on the banks of the St. Johns River in Jacksonville’s Ortega neighborhood.

The Florida Yacht Club (FYC) in Jacksonville, Fla., was founded in 1876 by New York business- man William B. Astor Jr., with the purpose of promoting yachting and social enjoyment.

Jacksonville—accessible by rail and water, site of grand hotels and known for its pleasant weather—was a winter haven for affluent families of businessmen whose fortunes were bolstered during the Industrial Revolution. The first clubhouse, located in downtown Jacksonville, burned down in the Great Fire of 1901—one of the worst disasters in Florida history and the third largest urban fire in the United States.

After a brief stint in a temporary location, the club pressed on. FYC relocated to a generous parcel of creek-front property until it eventually outgrew that site. In 1928, FYC welcomed members to the handsome Mediterranean Revival-style clubhouse that is its current home. Truly a hidden jewel in Northeast Florida, the campus is tucked away in a beautiful waterfront location on the banks of the St. Johns River in Jacksonville’s Ortega neighborhood.

Charting a Course for the Future

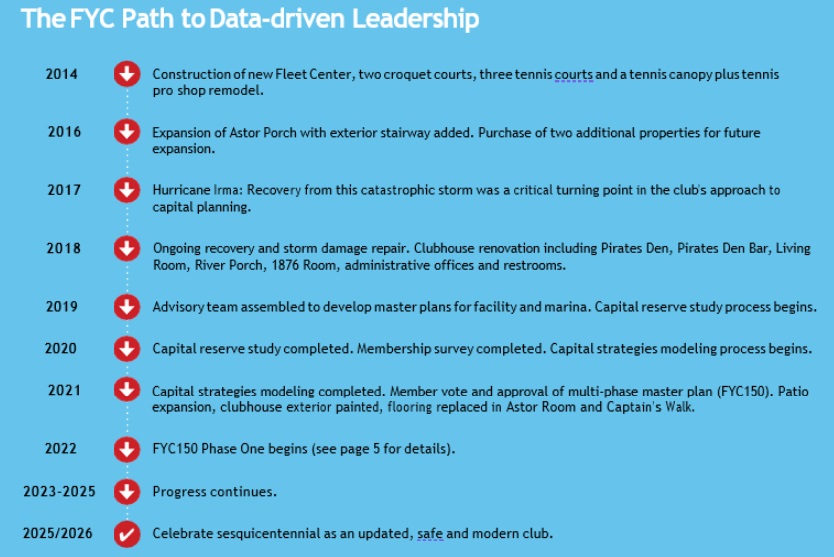

In 2017, FYC’s board understood the urgent need to repair damage from Hurricane Irma, but the thought of shelving much-needed improvements aimed at providing an exceptional member experience and keeping the club competitive in Florida’s saturated market was disappointing. Edell credits the tenacity of Past Commodore Wilson Studstill (2019) for bringing the budget into focus.

Studstill fiercely advocated for developing a comprehensive capital project inventory, which he believed was essential to create a working financial model and forward-focused strategy. The first step was a capital reserve study to inventory, evaluate and document the club’s physical assets. The Club Benchmarking study and resulting report provided leaders with a 20-year forecast for the servicing and/or replacement of each club asset—the club’s obligatory capital requirements.

Current Commodore Tim Monahan believes that by shifting toward a more data-driven approach, the club’s leaders proved their commitment as stewards of a nearly 150-year legacy. “The board recognized that we were in a place where we needed to firmly grasp the financial health of the club in terms of what was essential to operate on the level that the members desired and, of course, deserved,” Monahan explained. “The data and numbers that Club Benchmarking compiled brought those realities into focus. When we committed to engaging reputable professionals to provide their expertise—whether it was the architects, engineers, or financial strategists—we were investing in partnerships to secure the future of the club.”

With the existing assets fully documented through the capital reserve study, capital strategies modeling specialist Eric Gregory, CCM, looked at the results and reviewed the club’s operating ledger and existing sources of capital income to ascertain an overall financial picture. He presented those findings at the board’s 2020 retreat. The overall picture was not especially alarming, but it was clear that if the club continued to operate as it had been—leaning heavily on non-dues revenue from activities like weddings and banquets to fuel operations as opposed to relying on a healthy dues stream—it would be very difficult to find the money to invest in obligatory capital projects (repairs and replacements), much less take on aspirational projects (improvements and additions).

“They had fallen into the cycle that a lot of clubs find themselves in,” Gregory explained. “They were approaching banquets and non-member events as a significant driver of covering the club’s fixed operating costs. This tends to create a culture where volume and efficiency become prioritized over what really matters: consistently providing an excellent member experience. Not only does the service mindset need to shift to remedy this, but the club’s whole financial model often needs to be altered to support a club for and funded by the members.”

After analyzing data from the club’s 2019 fiscal year and comparing FYC to a data set from peer yacht clubs, Gregory presented those findings to the board. He benchmarked FYC in a variety of key performance indicators, explaining that in a comparison set of clubs, gross profit attributable to member dues was 81% at the median while at FYC, only 66% of gross profit came from member dues. This indicates that the other clubs are much more dues oriented than activity oriented. Furthermore, FYC was making a profit in F&B equivalent of 9% of dues revenue while the median club in their peer group was subsidizing F&B by 4% of dues revenue.

In comparing FYC’s dues ratio to the peer set, FYC was well below the median, with only 31% of its total revenue coming from the dues line as opposed to 37% at the median yacht club. While FYC’s total dues revenue was more than $1 million less than the median club, its non-dues revenue was higher, which resulted in comparable overall revenue stream. The big difference is that FYC relied on non-member activity (as opposed to member dues) to generate revenue, so the club was bringing a lot of

non-members to the facility to utilize the its assets, which often detracts from both the member experience and value. The shift in mindset from volume and efficiency to improving the member experience is critical for clubs to sustain optimal membership counts and the associated capital income to drive the cycle of growth.

Measuring Member Perspectives

In December 2019, Edell asked Club Benchmarking to develop, facilitate and unpack the results of a membership survey to help the leadership better understand members’ priorities. After a thorough consultation about the club’s goals, a survey was drafted that asked members to provide their opinions by responding to general questions about FYC’s service, amenities and facilities on a seven-point Likert scale. The goal was to create a benchmark management could use to make immediate, impactful improvements to the club.

The confidential, anonymous survey was emailed to members and their spouses. Overall, the FYC member survey received an impressive 63% response rate, ensuring the results represented the greater member- ship with a 3.25% margin of error. For perspective, the average response rate for similar surveys is around 50%. Morin explained that working with a third-party consultant to administer a member survey helps with transparency and protects club leaders who otherwise might fall under suspicion of misinterpreting the results or pushing a specific agenda.

At its heart, the purpose of the survey was to transform the resultant data into a fact-based strategy for scheduling capital improvements based on feedback from the members. FYC’s results demonstrated high levels of member satisfaction and a high Net Promoter score, well above the industry average.

The survey results indicated there were 10 specific areas of the club’s operation that were of high importance to members and not meeting member expectations to varying degrees. These areas ultimately shaped the strategic objectives of the club’s master plan leading up to the sesquicentennial.

Zeroing in on a Strategic Model

The next step was to understand how those plans could be brought to fruition. Armed with the member survey results and capital reserve study data, including documentation of existing debt, Gregory worked with the board to ascertain their long-term priorities and goals. Gregory used a process called capital strategies modeling to develop several options for the board to consider and, eventually, present to the membership as a key component of the club’s multi-year strategic vision.

Dubbed “FYC150” in recognition of the club’s impending milestone, the multi-year strategic plan factors in both the club’s obligatory capital requirements and the aspirational improvements aimed at transforming the 100-year-old clubhouse and ensuring a strong and vibrant member- ship well into the future. Design firm Peacock + Lewis consulted with FYC members, management and the Club Benchmarking team to develop multiple conceptual iterations addressing facility and functional- ity improvements in three phases.

After consultation with Applied Technology and Management (ATM), a highly regarded marine geological planning and design firm, FYC150 includes a comprehensive plan to protect the club’s front basin assets, provide attenuation of the St. Johns River for all the front docks and ensure that day boating remains a viable asset and amenity for the club.

Embracing a data-driven approach that aligns with industry best practices, the plan includes incremental initiation fee increases over the next 10 years and a scheduled increase in monthly capital dues of $10 per year for the next 10 years. The funds will be kept in a special capital account to be used solely to service or retire long-term debt and to pay for routine and emergency capital expenditures. In addition, a one-time special assessment will raise $750,000 to fund transformational projects in Phase 1 of FYC150:

- Construction and renovation of a poolside casual dining area.

- Renovation of the pool and pool deck.

- Update to the membership entry.

- Two ADA-compliant restrooms to serve indoor and outdoor areas.

- Three pickleball courts.

- Front basin restoration.

- Clubhouse and office renovations.

- Renovation of the club’s 60-year-old kitchen.

“FYC’s approach to budgeting has really evolved over the course of our ongoing partnership with Club Benchmarking,” said 2022 Commodore Tim Monahan. “They did the research and presented us with the fact-based results. We now know that if we take the long view when deliberating over discretionary capital requests and make decisions more strategically rather than in a reactionary manner, FYC will secure its future. To me, the finesse in the process comes in after the science … Club Benchmarking handled the science by compiling and analyzing the data; the art is in taking the data and melding it into the culture of the club, taking care to honor our history and traditions and at the same time offering the amenities desired in a modern club environment. FYC leadership has gotten its footing, the path is clear and we have a bright future on the horizon.

Member Perspectives Key to Successful Planning

The success of long-term planning hinges on how well club leaders understand members’ collective preferences and priorities. A thorough, thoughtful and objective member survey is often the first step in that process and the insights gleaned are an integral resource in shaping a path forward. In 2019, during the earliest phases of Florida Yacht Club (FYC) leaders’ effort to envision the club’s future, a survey was conducted to evaluate member satisfaction and priorities regarding future plans for services and amenities.

Two key performance indicators (KPIs) used to quantify how current members feel about the club are Member Satisfaction and Net Promotor Score. On both those measures, survey results confirmed FYC members have a deep love and appreciation for their club.

In response to the statement “Overall I am very satisfied with my experiences at The Florida Yacht Club,” 34.72% of FYC respondents strongly agree (7 on a Likert scale of 1 to 7), while 47.44% answered 6 and 14.42% answered 5. The club’s overall satisfaction was 96.58%. The mean satisfaction score of 6.10 out of 7 is well above the industry benchmark of 5.77.

The second KPI, Net Promoter Score, is a research-based question created by Bain & Co. to measure the market’s loyalty to a business or brand. NPS participants rate how likely are they to recommend a brand to friends or family on a scale from 0 to 10. Responses of 0 to 6 are negatives and less like to come back or to promote the brand.

Responses of 7 or 8 are considered neutral—neither positive or negative—and a 9 or 10 indicates a respondent who is likely to actively promote the brand.

FYC has a Net Promoter Score of 59.58, which is well above the club industry average of 43.76. For context, Comcast Xfinity has an NPS of 5 and Delta Airlines has a score of 45.