On March 31, 2020, Club Benchmarking released a whitepaper titled “The Framework for a Strategic Response to the Coronavirus Crisis” which was intended to provide a data-driven framework that would help clubs navigate decisions in the face of the crisis The thesis presented was that successful clubs embrace a member- centric business and financial model and that the clubs most likely to feel the brunt of the pandemic shutdowns were those that had, after the Great Recession, moved away from such a model. Those clubs that opted for a quick fix, courting nonmember revenue from banquets and golf outings or attempting to fund operations through non-dues revenue from members instead of through member dues.

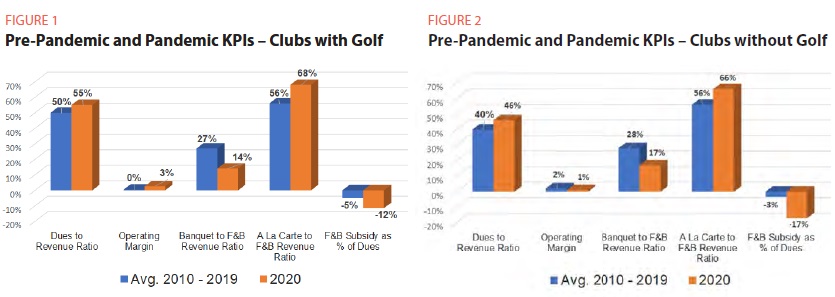

The financial data that Club Benchmarking has been studying for more than a decade has resulted in discovery of Key Performance Indicators (KPIs) which identify the successful and flawed choices clubs make in terms of funding operations. One of the first KPIs identified was the Operating Dues to Operating Revenue Ratio. The data clearly shows a member-centric experience funded by member dues more than by ancillary fees and charges or non-member revenue leads to healthier financial outcomes. Figures 1 and 2 on page 11 present KPIs that capture the impact of the pandemic. Pre-pandemic data shows the KPI averages from 2010–2019. KPIs for the pandemic year show fiscal year-ends between 7/31/20– 6/30/21. Several bits of insight emerge. The largest revenue impact was on banquet revenue. Most clubs did not hold banquets during pandemic restrictions on gathering, certainly not for non-members. Banquet revenue as a proportion of F&B revenue was cut in half thus increasing the proportion of member à la carte revenue. As a result, the Dues Subsidy of F&B more than doubled. Club Benchmarking has not been shy about the fact that F&B is a member amenity in a private club – not a profit center. The pandemic forced clubs to embrace the member-centric model of F&B. The data is clear; clubs subsidizing F&B the most are the healthiest clubs and those making a profit or minimizing F&B deficits are the weakest.

• One of the key messages in the white paper was that clubs must realize the operating ledger is not a financial driver. It is the vehicle for delivering services and amenities to the members and 90% of clubs set the operating ledger to break-even excluding depreciation. Historically clubs do a fantastic job of breaking-even year after year. Even during the pandemic, as shown by the Operating Margin KPI, clubs broke even (actually clubs fared slightly better as a result of the Employee Retention Tax Credit. The point is clubs understand how to manage the operating ledger. Their financial focus must be the capital ledger which the data shows requires much greater attention across the industry.

• The KPI that best captures how clubs fund operations is the Operating Dues to Operating Revenue Ratio. Clubs with a more member-centric business and financial model rely more on dues revenue than on outside revenue or ancillary fees and charges. The median for clubs with golf in “normal” market conditions is 50% and 40% for clubs without golf. Clubs should generally be striving to increase this ratio over time—the power and reliability of dues revenue having been made crystal clear over the last 18 months. As can be seen in Figures 1 and 2, the median ratio reflected the existence of a more member-centric experience during the pandemic as the ratio increased to 55% in clubs with golf and 46% in clubs without golf.

As has been communicated throughout this issue of Club Business, all clubs, including The Landings Club, were forced to embrace a member-centric business and financial model during the deepest days of the pandemic. As the data shows, even with the greater F&B subsidy, clubs still managed the operating ledger to break-even. The white paper focused heavily on what to do after the pandemic and presciently pleaded with clubs to embrace a member-centric model and focus on developing a compelling member experience while focusing financially on the capital ledger as the financial driver over time. The results of clubs during the pandemic demonstrated clubs can, and will, succeed with the member-centric approach.

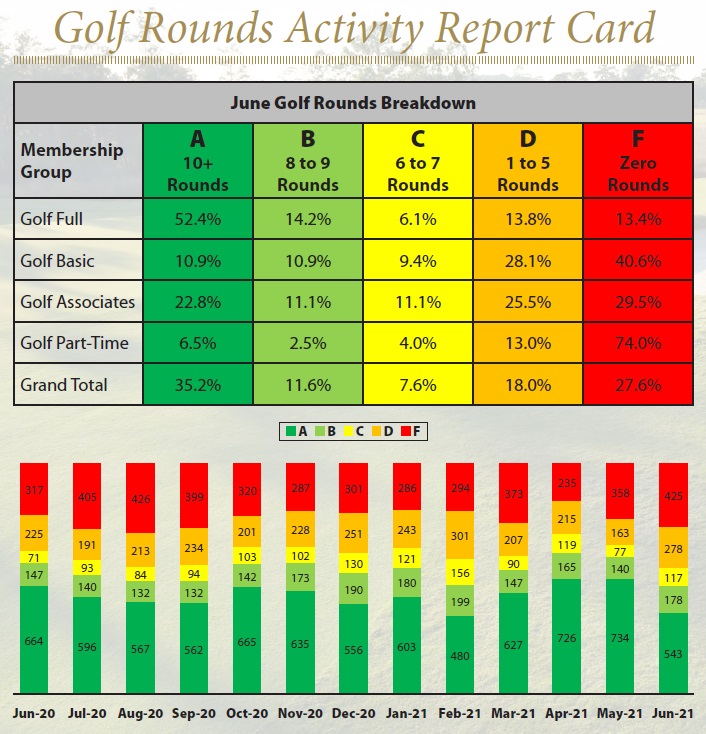

Measuring Member Engagement

Member engagement is a very important concept, but it would be impossible to measure without data. At The Landings Club, we have developed our own simple formula. Each month, member usage is tracked against three important metrics: number of golf rounds played, number of visits to our Wellness Center and dollars spent in our à la carte dining locations. Using that data, member activity in each of those three areas is categorized with a corresponding letter grade from A to F. As an example, a member who played +10 rounds of golf in a month would be an A for the month (no names of course) while a member who played zero rounds is an F. We calculate the percentages at each the level of engagement to better understand the impact of our programming and offerings. The end goal is to drive activity and improve our efforts to elevate value received by our members.

Ray Cronin is Founder & Chief Innovator at Club Benchmarking.