Do you cringe before looking at your club’s annual health insurance renewal? You know you’re getting hit with another increase; it’s just a question of how much. You ponder changing plans, switching carriers, asking more from the employees, or finding more money in the budget—all of which come with a certain level of pain, no pun intended.

Health care spending in the United States is approximately $4 trillion a year. The U.S. spends more money per capita than any other country, and yet doesn’t rank in the top 30 in most world health rankings. With increasing costs and an unhealthy population, experts project that by 2025, 25 cents of every dollar in America will be spent on health care. What can be done now to help stop ongoing double-digit increases on medical insurance?

Obstacles to Lower Costs

There are three primary obstacles to lower costs.

1. Lack of Transparency. Confession, I’m a CPA who can’t figure out medical bills. With insurance companies as the middleman, it’s impossible for anyone to know the real costs. If you’ve been admitted to a hospital, you know what I mean!

2. Perverse Incentives. Under the Affordable Care Act, individuals are protected from losing their health insurance. When people get sick at no fault of their own, they should be protected. Yet, people should also be accountable for high-risk behaviors. Unfortunately, a great health insurance plan with low co-pays reduces a person’s incentive to get healthy. Health care providers also lack the right incentives. They get paid when they treat you and not when they cure you.

3. Administrative Costs. There is too much “red tape” involved in our current health care system today. All the insurance paperwork and numerous provider billings add to the premium rates. Much of my argument below involves creating direct transactions between the consumer/patient and the provider/doctor, thereby eliminating the need for insurance for basic services, and add the administrative costs that come with it.

Consumerism in Health Care

Imagine buying car insurance so you can get your oil changed for “free.” When you have your vehicle serviced, they don’t tell you what it will cost. Instead, they send a bill for $1,000 to your car insurance company who negotiates the bill on your behalf. The insurance company negotiates it down to $500 then pays 80% and sends you a bill for the balance. They could also arbitrarily decline coverage. Either way you’re questioning why you bought the insurance. When you call to complain they direct you to contact the oil change shop and the oil change shop says to contact your car insurance company.

The point being that we buy car insurance for catastrophes like accidents and stolen vehicles. And that’s how health insurance originated, to cover unexpected hospital bills. Over the years with the help of new government policies, we pay for health insurance for basic services whether we use them or not.

The good news is a slow moving but significant trend toward high-deductible health plans (HDHPs). The obvious attraction is lower premiums. Employees often fear them because of what they might have to pay out of pocket. The exposure of high deductibles can be offset with Health Savings Accounts (HSAs) and Health Reimbursement Accounts (HRAs). High-deductible plans put more responsibility on the individual to manage their health care costs while HRAs and HSAs can both protect and reward them.

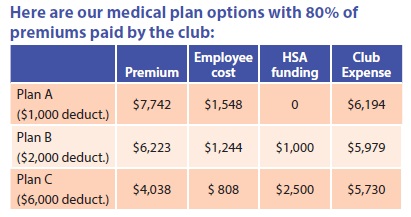

I introduced high-deductible health plans (HDHPs) at my club several years ago. Coupling HDHP options with club-funded health savings accounts has lowered costs while increasing discretionary health care spending for employees.

Why a Health Savings Account?

Funding HSAs for our employees gives them more control of how to spend their benefit dollars. They become “shoppers” and have a vested interest in the process. Like consumers, their expectations of price and experience change. In the bigger picture, as more money flows into the hands of individuals, providers will be forced to become more transparent and competitive in pricing.

Instead of offering health savings accounts, clubs can set up a health reimbursement account (HRA). HRAs are owned by the employer and used to subsidize a portion of an employee’s out-of-pocket costs. This can be favorable to a club because it only pays out when an employee submits a medical bill. HRAs are less costly but I believe HSAs are better in the long run because they drive consumerism in health care.

Benefits of a Health Savings Account

- HSAs can be used for most any medical, dental, vision, chiropractic services and prescription drugs.

- The account is owned by the employee and is portable.

- Employee contributions are pre-tax and grow tax-free if invested.

- Employees and employers can contribute up to $3,600 for single coverage and $7,200 for families with an additional $1,000 for those 55 and older.

- At age 65, you can use the money for any reason with no penalty, but you may be subject to taxes.

Other Trends in Health Care

Self-Insuring. Also called self-funding, employers can pay claims directly instead of paying premiums to an insurance company. The upside is significant savings, especially if you have a healthy group of employees. With self-funding, consider purchasing stop-loss insurance, which will pay claims once they exceed a specified amount. You can easily hire a third-party administrator to do all the paperwork.

If the club industry banded together and self-insured a larger group, thereby lowering risk to any one club, the potential savings could be huge. Health and Wellness. More clubs are adding or expanding fitness centers for their members. If being healthy is part of the culture at your club, does it include your employees? Are you doing more than just annual health screenings? There is an obvious benefit to helping your employees get healthy, yet often gets little attention as results are not immediate. Here are a few ideas:

- Healthy employee meal options, including a healthy “snack of the month”

- Group exercise classes on site

- Negotiate discounts rates at a nearby health club/gym

- Walking meetings

- Classes on healthy eating Incentives to quit smoking/insurance reductions for those who don’t smoke

- Stress awareness classes

What Clubs Can Do Now

1. Offer more options. Insurance companies offer a wide variety of medical plans, so take the time to study and design an offering of two to four plans with at least one high deductible plan. Pick the most attractive plans for your group by getting feedback from employees before making your decisions.

2. Initiate Health Savings Accounts. They’re easy to set up. Employees receive a debit card that you can fund monthly. Know there is a deductible threshold for plans to qualify for HSAs. Health reimbursement accounts are usually more cost-effective for the employer as the unused dollars are retained by the club. Understand that HRAs don’t have the same long-term effect as a health savings account. HSAs increase the sense of “ownership” an employee has in their health and health care costs.

3. Conquer their fears. People fear change and even more, they fear medical bills. Changing carriers or moving to a high deductible plan can be scary for employees. For a high risk, heavy user of health care, a lower deductible plan often makes more sense. For most, the fear is simply based on uncertainty, so show them the benefits and risks so they can make informed decisions.

4. Be diligent and educate yourself and your employees. As health benefits continue to be a bigger part of your operating expenses, you should have a clear understanding of insurance. Brokers are well versed in this area, but know they are incentivized to sell you higher premium plans.

Health care prices continue to be a major issue in the U.S. We must create a check and balance on providers. This starts with shifting more of the $4 trillion dollars into the hands of individuals, thereby giving them more say in the cost of care.

Jeff Willey, CPA, is controller at Bay Head Yacht Club in New Jersey. He can be reached at [email protected].