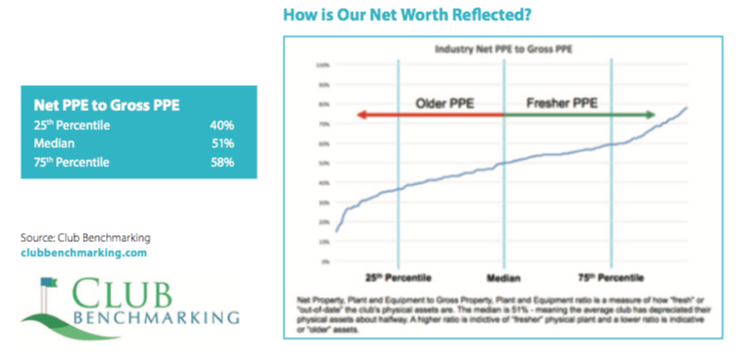

Shifting board focus from the income statement to the balance sheet is a critical first step in addressing the issue of sustainable financial success for your club. In this edition of Data Mining, we look to the balance sheet for information about the club’s PPE (Property Plant and Equipment) that we will use to calculate a very important number – Net PPE to Gross PPE Ratio. Club Benchmarking data shows the median Net PPE to Gross PPE Ratio in the club industry is 51%.

Shifting board focus from the income statement to the balance sheet is a critical first step in addressing the issue of sustainable financial success for your club. In this edition of Data Mining, we look to the balance sheet for information about the club’s PPE (Property Plant and Equipment) that we will use to calculate a very important number – Net PPE to Gross PPE Ratio. Club Benchmarking data shows the median Net PPE to Gross PPE Ratio in the club industry is 51%.

You’ll find what you need to calculate your own ratio on the club’s balance sheet. First, determine your Gross PPE (excluding land, which is not depreciated). Next, determine your Net PPE (after accumulated depreciation). Divide the Net PPE by the Gross PPE to arrive at the Net PPE to Gross PPE Ratio.

By analyzing industry data and applying context through hundreds of onsite visits, we know that clubs with ratios below 40% are likely to have physical assets that are more worn and depleted, while clubs with ratios of 60% or higher have physical assets that are newer and up to date. The ratio is a very simple, quick check of where your club falls and your position relative to industry norms. In the end, a precise assessment entails your club completing a Capital Reserve Study and asset condition assessment.

The Net PPE to Gross PPE ratio is critical because it forces focus by the board, finance committee and staff on capital and the balance sheet which is where long-term, financial sustainability is found. The most important financial KPIs are on the balance sheet. Unfortunately, the income statement remains the center of attention to the detriment of many clubs.