LAST YEAR, THE U.S. DEPARTMENT OF LABOR (DOL) established new guidance for the classification of workers as either employees or independent contractors (ICs). The guidance now makes it more difficult to classify employees as ICs, leaving clubs with ICs more vulnerable to litigation and penalties. In response, the National Club Association and the Western Golf Association (WGA) have joined forces to survey our members that have caddie programs in an effort to determine how this change might impact this particular category of worker. Sixty-three clubs completed the survey. The respondents represented a cross section of clubs from across the country and include caddie programs of varying sizes. These responses provide a better understanding of how clubs currently classify caddies and give an indication of how clubs may address the DOL’s guidance on IC/employee classification for caddies in the future.

New Guidance

The DOL requires club leaders to consider a multi-factor “economic realities” test to classify workers. These factors are to help establish whether the worker is economically dependent on the club or whether he is truly in business for himself and economically independent from the club. The factors outlined by the DOL are:

Is the work performed an integral part of the club’s business?

If the task your worker performs is integral to the club, then he is likely an employee and not an IC. Work can be integral even if it is just one component of the club’s business. Thus, if a club requires the use of caddies then they would likely be seen as integral to the club’s business, and it is highly likely those caddies would be considered employees.

What is the worker’s opportunity for profit or loss depending on his own managerial skills?

If your worker does not have the ability to make business decisions and use his initiative to affect his profits or losses, then he is likely an employee and not an IC. This factor does not refer to someone deciding to work more hours to make more money (like a caddie deciding to work more rounds), but rather his use of managerial skills and business acumen to impact his success. The guidance also stresses that the worker’s ability to incur a loss is just as critical as his ability to make a profit, and without it the worker is likely an employee.

What is the extent of relative investment in each business by the club and the worker?

If your worker makes only a minimal investment in his business, then he is likely an employee not an IC. Investments in advertising and marketing provide better indication that he is in business for himself and an IC. A golf pro’s investment in golf clubs and teaching equipment alone would not be enough for him to be considered an IC when compared to the club’s investment in the course.

Does the work performed require special skills and initiative?

This does not refer solely to the worker’s technical skills, but his business skills, judgment and initiative, too. If he needs specialized skills to do the work, then he could be an IC. However, you will need to determine whether he exercises independent judgment and initiative when using those skills before classifying him as such. If the club hires a pastry chef who decides what to make and when to make it and if he has his own pastry shop and markets his services to others, then he would be an IC. In contrast, that same specialized pastry chef who is brought in by the club each week and told what to make and when to make it would be classified as an employee. This factor closely resembles that of an employee’s managerial skills, but is more directed to workers with a specialized skill. The goal is to ensure a club does not automatically classify a worker as an IC simply because he is skilled at a certain task.

How permanent is the relationship?

If your worker stays with the club until he decides to quit or is fired, then he is likely an employee and not an IC. A worker in business for himself does not want to be tied down to one club. He will come and go as he pleases based on his best business judgment. If a caddie only works for the club and does not seek other clients, then he would be seen as an employee. On the other hand, if such a worker provides services for numerous clubs and other fitness facilities, negotiates different rates as well as different terms of engagement, then he would be seen as an IC. What is the degree of control exercised by the club over the worker? If your worker does not control crucial aspects of the job, then he is likely an employee and not an IC. The nature of control by the club will be determinative here. Thus, the fact that a caddie schedules his own rounds will not cause him to be an IC if the club controls when those rounds may occur and how much he may charge.

The new guidance emphasizes that no single factor will be determinative. Instead, a club should look at all of these together to determine how economically dependent or independent the worker is from your club. Unfortunately, this DOL guidance made clear that the Fair Labor Standards Act’s (FLSA’s) definition of employee is to be liberally construed to “provide broad coverage for workers.” DOL also stressed that the basic intent of the FLSA is to label most workers as “employees.”

Survey Results

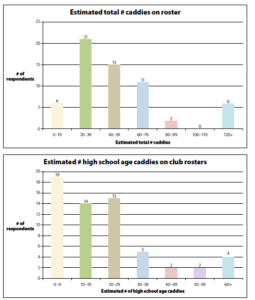

Here is a look at several key findings in the NCA/WGA survey. Program Size Club caddie programs are diverse in size. Nearly 60 percent of responding clubs said they have between 20 and 60 caddies on their rosters. The most common response was between 20- 39 caddies, with 34 percent of clubs reporting that range. However almost one-third (31%) of those surveyed said they have 60 or more caddies on their rosters, and nearly one in 10 clubs reported having 120 or more caddies.

Minors

More than two-thirds (69%) of the surveyed clubs said they had 10 or more high school-aged caddies. About one-fifth (21%) of clubs said they have at least 30 or more high school-aged caddies on their rosters. Most clubs bolster their young caddies’ educational aspirations by participating in a caddie scholarship program (75%).

Number of Rounds

Caddie programs support a wide number of rounds played. A little more than half (54%) of clubs said their caddies worked fewer than 6,000 rounds per year. Nearly one quarter (23%) of caddie programs provided caddies for more than 10,000 rounds per year.

Classification

The vast majority (92%) of surveyed clubs said they classify their caddies as ICs. Only 3 percent said they classify their caddies as employees and just 5 percent said they use caddies that are managed by a third party vendor.

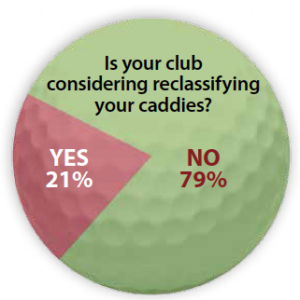

Although the DOL’s new guidance on ICs increases scrutiny on employee/IC classification, only 21 percent of those surveyed said they would consider reclassifying their caddies.

Of those clubs, here are some of their written responses.

Of those clubs, here are some of their written responses.

“We have met with a labor attorney to review our caddie procedures to see if there were changes in procedures we could make to be in compliance. We have been reaching out to try to determine how other comparable clubs nationally are handling the DOL issue as well and trying to analyze the impact of making the change if necessary.”

“Management is working with the employment counsel on how best to address the classification revisions. There is consideration being given to making all caddies club employees in 2017.” The remaining 79 percent of clubs said they are not considering reclassifying workers. Many feel confident that their workers are already properly classified. Here is what some of these clubs had to say. “The club is watching closely to see how the new guidance is managed and enforced. Currently, the club’s auditor and legal committee feel the independent contractor classification is correct.”

“We are aware of the rules and work hard to be in compliance on a daily basis.”

However, several of the clubs that are not currently considering reclassifying staff and ICs are still unsure of whether they will ultimately make a change in worker classification. Here is what some of them had to say. “We haven’t yet studied whether we would be ‘not in compliance’ with the new law. If we were required to treat caddies as employees, it’s possible we would ‘terminate’ the caddy program. We will continue to classify caddies as independent contractors until we ascertain the full implications of the new guidance.” “It will depend on what actually develops on this front. We have made the board aware that our long established traditions may be impacted by this new guidance.”

NCA Recommendation

When the DOL changed their IC classification guidelines, it dramatically altered the staff makeup for many private clubs. As such, NCA strongly urges all members currently using independent contractors to discuss the new DOL guidance with their club counsel. In addition, club leaders should review their worker classifications and make appropriate changes where necessary. In the end, it seems clear that the current DOL guidance has made classifying caddies as independent contractors far more difficult. Though the DOL has not made caddie programs a focus for enforcement right now, each club should be aware that failure to properly classify a caddie—especially younger caddies— could cause not only significant legal liability but place the club in an especially bad light with the public and its members. NCA will continue to fight against the new guidance, but until there is a change in the DOL’s perspective, be prepared to make changes as needed.

If you have any questions regarding independent contractor classification, please contact NCA’s VP of Government Relations & General Counsel Brad Steele at steele@nationalclub.org.