Employee financial wellness programs—like traditional wellness programs that focus on health and fitness—are being offered more and more as benefits at companies across America. Similar to physical wellness programs, financial wellness programs focus on education, counseling, incentives and competitive games—all aimed at helping workers reduce debt, increase savings, plan for retirement and modify bad spending habits.

These programs can help boost employees’ financial literacy and decision making, help them establish financial goals, empower changes in behavior, and minimize stress—making work a more productive and rewarding experience for both employees and employers.

(See “Impact of Financial Stress on the Workplace” on page 27 for additional information on personal financial stress and consequences for the workplace.)

What Is Financial Wellness?

According to Robert Powell, editor of Retirement Weekly, financial wellness is a state of mind in which one has minimal financial stress, a strong financial foundation with little to no debt and savings for emergencies, and is living below his or her means with a plan that helps them secure their financial goals.

Given the growing interest in financial education and the impact financial stress has on the workplace, many organizations have begun to implement financial wellness programs. In 2013, 76 percent of employers said they were interested in providing financial wellness programs, and last year 93 percent of employers said they were planning to institute or expand such offerings, according to an Aon Hewitt survey.

According to Powell, financial wellness programs should offer unbiased consultation geared toward changing employee habits and behaviors and helping employees make well-informed financial decisions and financial plans. These programs should integrate with other employee benefits and offer a holistic approach that provides assistance to all employees on a breadth of financial issues. Though wide-reaching and comprehensive, these programs should be tailored to each employee’s needs.

Often, employees take a financial wellness assessment test that identifies their strengths, weaknesses and vulnerabilities.

Powell notes that financial wellness programs should provide ongoing support—they are not a one-time event. The goal of these packages is to help employees develop fiscally responsible habits for their daily lives.

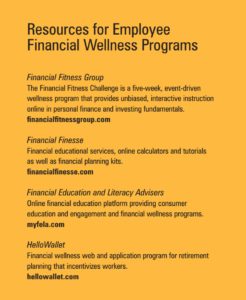

Workforce magazine emphasizes the need for clear and simple advice. Financial terminology can confuse employees. Easy-to- understand messaging that effectively uses tool such as calculators and “sliders” to indicate the impact of various levels of contributions can help facilitate the financial planning process.

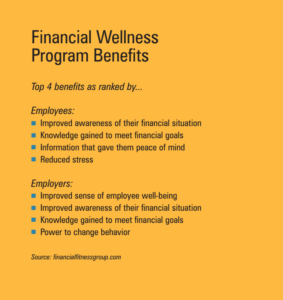

Benefits of Financial Wellness Programs

Benefits of Financial Wellness Programs

Successful financial wellness programs can help employees improve their financial well-being and mitigate the negative impacts of financial stress at the workplace. According to the Financial Fitness Group, a provider of workplace financial education solutions, employees who benefit from these programs take fewer sick days, have lower health care costs, plan more securely for retirement, spend less time dedicated to personal finances during the workday, perform at a higher level and have a stronger commitment to the company, in addition to other benefits. For a closer look at these findings, consider the following:

■ According to a Consumer Financial Protection Bureau report, a company that offers a financial wellness benefit can realize savings of $3 for every $1 spent on these programs.

■ In 2012, financial wellness program participants were absent from work 3.99 hours less per year than those who did not take part in the plan, reports Financial Finesse, a financial wellness program provider.

■ Companies that implemented financial wellness programs saw their health care costs decrease by 4.5 percent from 2010 to 2012, and those that did not offer programs saw their costs increase by 19.4 percent during the same time period.

■ Employees who work further into their lives may increase employer costs by thousands of dollars each year. The “Average 401(k) Deferral Rate” chart reveals the correlation between increased financial wellness involvement and higher 401(k) deferral rates, suggesting that employees who follow a financial wellness program may save their employers money by retiring earlier and with better preparation.

■ According to the Financial Education & Literacy Advisers, employees spend 28 hours each month researching their personal financial issues. They note that this can cost employers as much at $5,000 per employee annually in lost productivity. Effective financial wellness plans may reduce this number, benefiting both employees and employers.

■ In many instances it costs less to retain a worker than to replace one. The average annual raise for an employee is 3 percent, indicates Towers Watson, a professional services consultant. But the average pay increase for an employee who is moving from one job to another is between 10 and 20 percent, reports Forbes. Also, it costs an average of $20,000 to $30,000 to replace a manager who makes $40,000 annually, with variations based on the salary of the employee being replaced, reports the Society for Human Resource Management.

■ Each employee who participates in a financial wellness program may save his or her employer at least $450 after one year, reports the Personal Finance Employee Education Foundation. As these figures show, the savings gathered from financial wellness package benefits can be significant when extrapolated over an entire workforce.

Demographics

Financial wellness affects demographics differently, says Workforce. Millennials often use their phones to access important information. Financial wellness apps and internal online communities, with links to articles and social media pages, are ways plan sponsors can connect with this group.

Financial wellness affects demographics differently, says Workforce. Millennials often use their phones to access important information. Financial wellness apps and internal online communities, with links to articles and social media pages, are ways plan sponsors can connect with this group.

Many members of Generation X have hit the halfway point in their careers and should be focused on managing their retirement path. Financial wellness plan sponsors should help Gen Xers reevaluate their investments and ensure they are able to reach their retirement goals. Newsletters, videos and webinars may be useful tools to effectively communicate information to these employees. Gen Xers often deal with health care costs for elderly family members, creating additional challenges for the group as well as an opportunity for plan sponsors to address that financial burden.

Baby Boomers value a more personal approach as they head into retirement. Plan sponsors often schedule individual meetings with Boomers where they can answer specific questions, offer tailored advice, and build trust.

Financial Wellness Program Examples

According to The Wall Street Journal, media company Meredith Corporation offers workers the opportunity to earn and accrue points that can make them eligible for less expensive health plans. Employees can complete a 35-question “financial wellness checkup,” that asks if the employee is up to date on their bills and whether financial stress impacts their productivity at work, and can enroll in a course on refinancing their mortgage in order to earn points. Employee spouses can participate in the program and earn points as well.

The plan has been a success thus far. In 2014, 80 percent of the organization’s 5,200 workers and spouses finished at least one class provided by Meredith’s financial wellness package and 95 percent completed the wellness checkup questionnaire. Tim O’Neil, Meredith’s director of employee benefits and wellness, reports that employee financial stress has decreased and that employee focus at work has increased since the program began.

Many large corporations like Pepsi and Staples now offer financial wellness programs to employees, reports The Wall Street Journal. Pepsi has 15 counselors from PricewaterhouseCoopers to help employees take a foreclosure class or handle insurance claims after natural disasters. Staples offers their employees a fun approach to financial education— videogames. Approximately 15,000 employees have already played a vampire-themed game in which employees can learn how to save for retirement while competing with one another.

According to Financial Finesse, one large company saved roughly 22 percent on health care costs from employees who often used the employer’s financial wellness program over the course of a year.

Potential Downsides

Although there are many potential benefits from implementing a financial wellness program, clubs should consider potential negative impacts.

In some cases, employers offering financial advice to employees could make some of those involved feel uncomfortable. It also raises the question of how much an employer should know about an employee’s personal finances, especially if the employer, whether directly or indirectly, makes judgments regarding an employee’s spending behavior, indicates the Consumer Financial Protection Bureau.

Some employers remain wary of the potential increase to liability that could come from providing a financial wellness program. Offering financial advice to that degree raises many questions regarding an organization’s fiduciary duty and liability, although legal obstacles are being cleared away to encourage more employer involvement, notes Money. Increased administrative and scheduling duties are also another factor to consider when making the decision to offer a financial wellness package.

Employee Benefits on the Whole Are Increasing

Financial wellness is not the only benefit being offered more. In recent years, many employers have shifted toward increasing other benefits instead of raising wages, according to The Wall Street Journal. These packages include a wide variety of benefits such as gym memberships, cappuccino machines, the allowance of dogs in the office, wellness packages and free cellphones.

The reason is twofold. First, it represents the increased value many employees today place on work-life balance, subsidized commuting costs, health insurance and other items unrelated to wages. Second, it suggests that many employers are hesitant to commit to higher pay and would rather institute benefits that could be revoked when deemed necessary.

These decisions can be problematic and sometimes backfire on employers, however. Towers Watson reported in 2014 that 76 percent of employees say that their employers had recently scaled-back or increased the costs of benefits which may jeopardize their financial well-being. Reducing benefits, although easier to do than reducing wages for many employers, may create stress for employees and negatively impact the workplace.

Thirty-one percent of total employee compensation was given as benefits in the second quarter of last year, a two percent increase from 10 years ago, notes The Wall Street Journal. Hourly wages have increased at a sluggish 2 percent annually since mid-2009, and have increased by a total of 12 percent in that time. However, benefits have grown by a rate of 15 percent since mid-2009. And since 2001, benefits increased by 60 percent and wages by 40 percent.

Another possible reason for this trend toward offering more benefits is that the number of managerial and professional positions, which traditionally receive more benefits, has grown at a faster rate than service jobs, which traditionally receive fewer benefits.

As more employers are offering financial wellness programs and other employee benefit packages, clubs should carefully consider the impact financial wellness and other benefits that they offer to staff. These benefits may play a positive role in the employer’s and the employee’s finances.