THE THREE RULES OF INSURANCE:

- Insure anything you cannot afford to lose

- Do not spend more on insurance than the item is worth

- It’s not the probability but possible severity of the loss that matters most

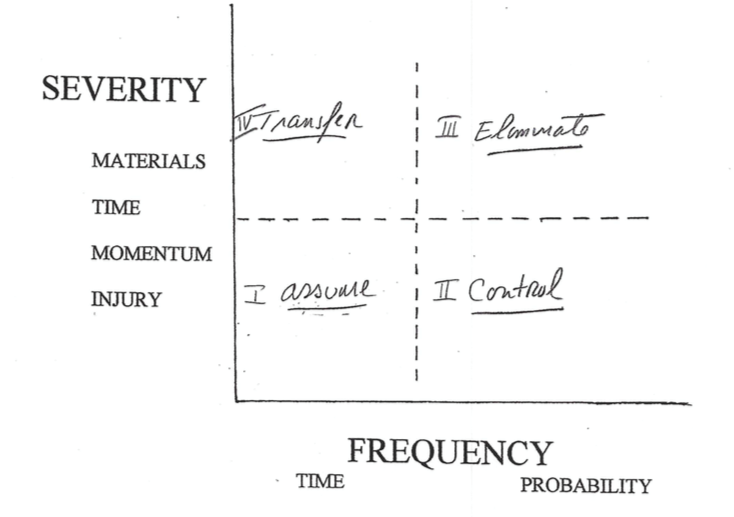

In the spring 2019 issue of Club Director, I described the first three steps in a four-step risk management program. The first three steps began with identifying the wide range of risk exposures your club faces: material/property, time, momentum and personal injury losses. The second step is to assess the likely probability or frequency and the possible level of severity. The third step is to chart the severity over frequency into four quadrants and label those quadrants. Your chart would look something like this.

Quadrant I recognizes that there are many risks at your club which are both low in frequency and low in severity; possibly not worth the cost to the club or inconvenience to the membership to avoid or closely manage. Examples of these are having petty cash for small check cashing or paying the caddies, accepting that fine china and glassware is easily breakable, choosing not to have attendants in your coat rooms and that you chose acceptable levels of deductibles on your insurance policies. For each of these you anticipate a low likelihood and a reasonable upper limit on the maximum severity of any possible loss.

Quadrant II assumes that there is a relatively high likelihood of an incident or loss, but that the severity is still relatively low and within an acceptable range. Security efforts around the club should reduce the likelihood and severity of theft, injury and loss of use of the facilities or services. Parking lots and walkways are kept well lit, staff are trained to prevent slip and falls, Safety Committees report dangerous conditions, the club maintains internal control procedures and the list goes on. The effort is to recognize hazards that may be unavoidable but might be mitigated by good risk management procedures.

Quadrant III shows that sometimes the risk is either too severe, too frequent or a combination of the two. Risks that fall into this quadrant are either eliminated or avoided as much as possible. It is rare these days to find a three-meter diving board at a country club or public pool. Most governing agencies no longer permit them, but before that became commonplace, insurance companies began denying liability coverage for them. Clubs could no longer risk the liability and it brought attention to the high frequency and severity of incidents. Clubs also recognize the risk of problem drinking and protect the club and their members by requiring ServSafe or TIP’s training, and by providing transportation home to those who need it. It has long been the practice of many clubs to have a no cash policy; everything must be charged to a member account. This eliminates the substantial expense to manage cash and risk of theft or loss. Many golf clubs have early warning lightening detection systems and require golfers and staff to get off the course when conditions are threatening. These are but a few of the more serious issues your board should be apprised of by its risk management professionals.

Quadrant IV recognizes the severity could be catastrophic, but the risk is inherent in the business. The choice may be to transfer the risk to either a professional service outside the club or to shift the risk to your insurance carriers. The riskiest of these is probably a substantial fire, but clubs also regularly insure for major theft and embezzlement, loss of fine arts and sterling trophies, general liability and casualty losses, employment practice and directors and officers insurance. Other dangers like tree pruning and exterminating apply to outside vendors who have special training, certifications and insurance.

The three rules of insurance will help you identify when and what level of insurance is necessary, but that is just one aspect of the risk management process. To operate a safe, caring and long-lived organization, leadership does not leave the finances, safety, reputation and momentum of the club strictly to chance. A thorough risk management program will identify the threats to your operation and provide your leadership the information and methods to fulfill the fourth and final phase of the program, to implement the safeguards. This is a major fiduciary responsibility of club leadership.

Robert C. James, CCM, CCE, CHE, is vice president, DENEHY Club Thinking Partners, a full-service executive search and management consulting firm serving the private club and boutique resort industries at more than 300 clubs and resorts on more than 700 projects. He can be reached at [email protected] or 203-319-8228. Learn more at denehyctp.com.