Part Five in a Series on Club Philanthropy

The series on Club Philanthropy has addressed a number of different types of methods in which clubs have established foundations for numerous charitable purposes. These range from art and library foundations to preservation foundations to foundations established to provide scholarships and employee hardship grants. Some qualify as charities and others do not. There was a large uptick in employee assistance foundations during the pandemic.

Members came together to help support their clubs’ employees and the generosity of the members was overwhelming. Despite the clubs either not being open or having limited access, members did all they could to make sure that the employees would receive at least some compensation during the closure or that health insurance was continued.

If not already in existence, the clubs created an “Employee Hardship and Disaster Relief Fund Program.” This is one way to get money donated by members out to employees quickly and tax-free. Under the Internal Revenue Code, employers are permitted to provide tax-free relief to employees in disaster circumstances. The Federal Emergency Management Agency (FEMA) maintains a list of declared disasters. While COVID-19 expanded its reach, these disaster relief programs have been around for a long time and in 2021 would also apply to those impacted by the wildfires out west and the various hurricanes that hit the shores of the United States.

Qualifications for Assistance and Scholarship Funds

To qualify as tax-exempt distributions, the program must be set up so the distribution is not considered compensation in any way and the distribution decision is independent and free of employer control (i.e., cannot be linked to performance-based compensation). To be considered a grant, there should be an objective determination of need or distress.

The IRS provides guidance on documentation of these funds, which includes:

- A complete description of the assistance

- Cost of the assistance

- The purpose for which the assistance was given

- The objective criteria for disbursing assistance

- How the recipients were selected

- The name, address and amount distributed to each recipient

- Any relationship between the recipient and officers, directors or key employees

- Substantial contributors to the organization

- The composition of the selection committee approving assistance

Additional best practice considerations include:

- Communication with employees regarding the nature of the monies as disaster relief, not compensation, is key

- Member donations should be maintained in a separate bank account, not comingled with operational funds

- Disbursements ought to be run through accounts payable rather than payroll

It is important to note that donations from members to the club generally are not tax deductible to the member. However, many clubs are establishing similar types of foundations that can accept contributions that will be deductible to the members as contributions. There are a number of additional steps that must be taken to ensure deductibility. If this is of concern to members, the club should set up a 501(c)(3) organization. This would provide the benefit of a tax deduction, as well as allow for a continuance of the program post-COVID-19. However, the foundation cannot be established solely to benefit the employees of the club in a compensatory fashion. In the past, the IRS has looked closely at these issues.

As we stated in earlier articles, one of the issues on which the IRS focuses is the importance of an organization not being operated for the benefit of private interests. Both scholarship foundations limited to employees and their families as well as emergency assistance programs run very close to the line. In fact, employee emergency funds frequently are run by third parties specifically set up for this purpose.

As stated on the IRS web site, there are two methods to qualify for scholarships to be nontaxable to the employee: the percentage test or the seven conditions test.

Percentage Test

For a program that awards scholarships to children of club employees, the program meets the percentage test if the number of children receiving loans under that program in any year is not more than:

1. 25% of the number of employees’ children who:

a. Were eligible,

b. Were applicants for such loans, and

c. Were considered by the selection committee in selecting the recipients of loans in that year, or

2. 10% of the number of employees’ children who can be shown to be eligible for loans (whether or not they applied) in that year. For purposes of determining how many children are eligible for a scholarship under this 10% test, a private foundation may include as eligible only children who submit a written statement (or on behalf of whom a statement is submitted by an authorized representative), or for whom sufficient information is maintained to demonstrate that:

a. The child meets the foundation’s eligibility requirements; and

b. The child has enrolled in or has completed a course of study to prepare for admission to an educational institution at the level for which scholarships are available and has applied, or intends to apply, to such an institution for enrollment in the immediately succeeding academic year with the expectation, if accepted by the institution, of attending the institution; or

c. In lieu of b) above, the child is currently enrolled in an educational institution for which scholarships are available and is not in the final year for which awards may be made.

In applying either percentage test, a private foundation may consider as eligible only individuals that meet all eligibility requirements imposed by the program, including any requirement that an individual meet the minimum standards for admission to an educational institution for which the lgscholarships are available.

Renewals of scholarships awarded in previous years will not be considered in determining the number of grants awarded in a current year. scholarships awarded to children of employees and those awarded to employees will be considered as having been awarded under separate programs whether or not they are awarded under separately administered programs.

Seven Conditions Test

If the lscholarship program satisfies the seven conditions, but does not meet the percentage test, all relevant facts and circumstances will be considered in determining the primary purpose of the program.

The seven conditions for approval are:

- Inducement – The program cannot be used to recruit employees or induce employees to continue their employment.

- Selection committee – Selection of scholarship recipients must be made by a committee of individuals who are totally independent and separate from the foundation or employer.

- Eligibility requirements – The program must impose identifiable minimum requirements for eligibility.

- Objective basis of selection – selection of recipients must be based on substantial objective standards unrelated to employment.

- Employment – Once awarded, it may not be terminated because the recipient or recipient’s parent no longer works for the employer, regardless of reason for terminating employment.

- Course of study – Courses of study may not be limited to those of particular benefit to employer.

- Other objectives – The course of study for which grants are available must be consistent with a disinterested purpose of enabling recipients to obtain an education for their personal benefit.

Receiving Approval

As with all foundations, approval needs to be received from the Internal Revenue Service as a condition for accepting charitable contributions. Due to the concern that these funds not be compensatory in nature, it is key that an attorney knowledgeable of nonprofit tax law be involved in any formation and application process.

Club Philanthropy

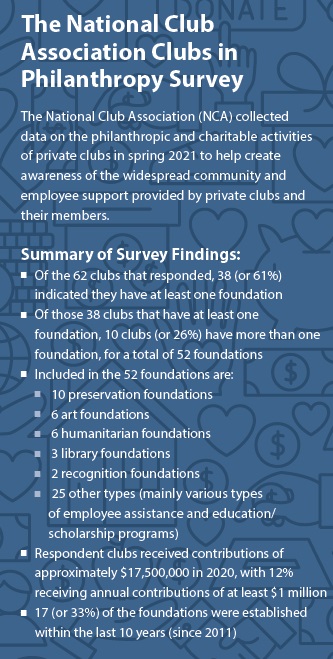

Clubs have increasingly used foundations to better the lives of their members, staff and their families, and the community at large. This trend is likely to continue as baby boomers age and make decisions to pass along more than $30 trillion in the next two decades. This series on club philanthropy provides a comprehensive look at the various types of club foundations and planned giving programs, their purposes, how to operate and fund them under the IRS’ purview, and how to keep them an active part of your club’s culture to benefit the current and next generation of the club community. All NCA members will receive the 5-part series on club philanthropy as a benefit of their membership.

Kevin Reilly is a partner with PBMares, LLP. He may be reached at [email protected]. Larry Absheer is the former CFO of the Missouri Athletic Club and currently serves as the director of advancement & liaison to the CEO. He may be reached at [email protected].