Have you ever looked at your workers’ compensation (W/C) loss runs?Or the incurred losses versus your medical-only claims? If you have had W/C losses and you haven’t looked at these line items, it is possible you are spending more money on insurance than necessary.

This article will share best practices for viewing your loss history, monitoring your injuries and complying with related Occupational Safety and Health Administration (OSHA) record keeping requirements.

Background

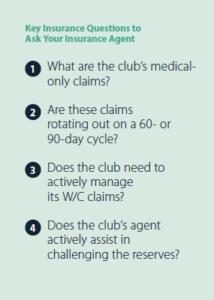

During an insurance seminar tailored to private club managers many years ago, a club industry agent/broker shared pertinent data about New York state W/C insurance rules and stated, “If you do not challenge your W/C reserves in 90 days; you then start paying premiums on the reserves.” Many clubs may be unaware of this tactic, however, it is financially prudent to understand the consequences.

An Example

Let’s say a kitchen employee cuts his finger with a knife necessitating an emergency room visit. The employee is treated—no stitches necessary—and returns to work with a bandaged finger covered with a waterproof finger cot. The injury report is filed in a timely manner with the W/C carrier and the bill from the emergency facility is $100.

The insurance carrier recognizes there is the possibility for an infection to occur requiring additional medical treatment and possibly even compensation for lost work time. So, for example, an additional $400 (the reserve) may be added, making the total potential injury claim $500.

If no further injury is apparent, the reserve should be challenged by day 90. If the club does not challenge the reserve within 90 days, it is possible the club will start paying W/C premiums on the $400 reserve. In some states, premiums on a W/C injury are paid for four years.

Do injuries such as described above have to be recorded on

300 log? The answer is found at the end of this article.

Varying Levels of Monitoring

Unfortunately, sometimes these W/C losses are so severe they impact the financials and it is necessary to utilize a Third Party Administrator (TPA). Smaller clubs often do not have the resources to regularly monitor their losses; and while larger clubs may have a human resource professional, this person may not be knowledgeable in monitoring the W/C losses.

TPAs are normally only brought in with non-standard insurance programs, usually at businesses with large deductibles or those who self-insured their losses. The TPA manages claims for both W/C and general liability losses. Therefore, for an insurance program with no or very little deductible, the insurer manages the claims as part of the premium or for a fixed cost.

Reserves

Reserves

According to Pat Cain, senior workers’ compensation consultant with Self Funding Inc., most TPAs set up medical-only claims with a generic initial reserve. For instance, if an employee injured on the job receives medical treatment for the injury, a medical-only claim applies if the employee immediately returns to work after the injury. The dollar amount depends on the TPA and the state jurisdiction of the claim. This allows the claim to be set up as soon as it’s reported. The generic reserve amount is used because it’s estimated as the average paid on a medical-only claim. If an employer feels the standard reserve amount is too high, the employer can arrange with a TPA for a lower standard reserve to be used.

The usual medical-only claim should be open a maximum of 60 days. If a medical-only claim is being kept open longer than that, the root cause needs to be determined. Is it still open only because the medical-only claim adjuster hasn’t reviewed it for closure yet? Or, because a final medical bill hasn’t been received and the adjuster hasn’t taken action to expedite receipt of that final bill? Either scenario is not the adjuster’s fault; TPAs typically over-assign medical-only claim adjusters, who may handle upwards of 200 to 300 claims.

If an individual is injured at work, has no lost time beyond the waiting period, and is working full duty and full time—why would that individual require more than two months of medical treatment? Granted, there are situations in which medical care does continue longer than 60 days, but these should be the exception. An important factor to consider is that some TPAs do allow a certain number of payments on a closed claim.

Another line item on your insurance policy to review is the “total incurred,” which is composed of the payment made to date plus a reserve for future potential payment. The reserve for future payment should never be based on a worst-case scenario. The reserve should be specific to the facts of each individual claim, and it should be based on all possible available information.

Costs of not Challenging Your W/C Reserves

Not challenging or failing to be aware of your W/C reserves can be costly. For instance, New York State requires businesses with a W/C modification (mod) rate of 1.21 or above and concurrently has an annual payroll in excess of $800,000 to hire a certified consultant to review the injuries and illness that resulted in the increased W/C mod rate. (A mod rate of 1.21 means the insurer is “potentially paying out” $1.21 of every dollar the employer is paying in premiums.)

In addition, a four-year history of injuries and illness is reviewed along with the incurred and reserved costs. A spreadsheet is developed by injury type to determine if there are recurring events. (It is recommended your clubs also review your injuries regardless of the state. For more information, please read “Club Safety Compliance and Best Practices” in the summer 2016 issue of Club Director.) The consultant must also perform a site inspection, determine what training is provided and concurrently assess what policies and procedures are in place. Recommendations and a report are then submitted to the employer.

During an audit of a large business that had never challenged a W/C reserve, nor knew they were paying premiums on medical-only claims, the consultant discovered the client had a ratio of 48–52 percent incurred losses to reserves! The client’s W/C premiums were nearly $1 million per year. Imagine your operation paying more than $400,000 annually on your medical-only claims reserves.

OSHA Recordkeeping Requirements

Workers’ compensation and your responsibility to compile and retain the OSHA 300 & 300A logs are somewhat related. OSHA logs do not require all W/C first aid incidents to be logged, however, they do require every recordable injury/illness to be logged within seven days of being incurred/reported.

Employers must record on their OSHA 300 log the work-related injuries and illnesses that meet one or more recording criteria, including injuries and illnesses resulting in death, loss of consciousness, days away from work, restricted work activity or job transfer, medical treatment beyond first aid, or a diagnosis of a significant injury or illness by a physician or other licensed health care professional.

OSHA regulations require the OSHA 300A log be posted annually between February 1 and April 30. The 300A log is to be signed by an executive of the organization certifying all incidents are reviewed and verified as accurate.

Alan Achatz of Club Safety Solutions is a former club manager and operates a safety consultancy helping clubs with hazard recognition, emergency action planning, OSHA compliance, safety audits and food safety. Club Safety Solutions will provide NCA members a 30-minute free consultation. He can be reached at 716-829-9148 or at clubsafetysolutions.com. Pat Cain of Self Funding, Inc., is licensed by the N.Y. Workers’ Compensation Board to handle claims for self-insured employers and to represent employers at hearings. She can be reached at [email protected].