During the last five years, we have been studying findings from the Club Benchmarking Governance Survey, a tool we use to evaluate board alignment and understanding of key issues. The research confirms our field-based observation that while most volunteer leaders are well intentioned, a large percentage don’t know what they don’t know about the club industry and its business model. We both admit to having fit that description at the beginning of what would be more than a decade of service on our own club boards.

Ongoing education is the best way to bridge the knowledge gap and it can also reduce the club’s exposure to the “I Know Better” (IKB) syndrome described elsewhere in in this issue. Like the misalignment and misunderstanding we see in survey responses, members who reject data in favor of their own ideas or opinions can derail the club’s success. Without education, the knowledge gap will expand over time and the long-term results can be devastating.

Those of us who have served on club boards realize nothing in life really prepares you for board service, which is why continuous, industry specific learning is so important. The goal of industry education is to shorten learning curves, accelerate the adoption of best practices and strengthen the governance foundation of private clubs.

Three Cornerstones of Great Governance: People, Resources and Focus

The formula for exceptional club leadership is relatively straightforward. It is a matter of getting the right people involved, equipping them with the proper resources and getting them to focus on what matters most. In our experience, clubs that succeed in mastering that formula will produce superior financial results.

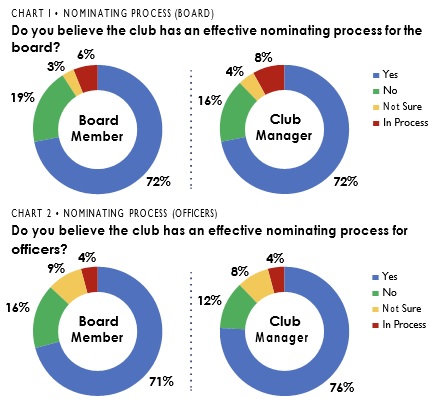

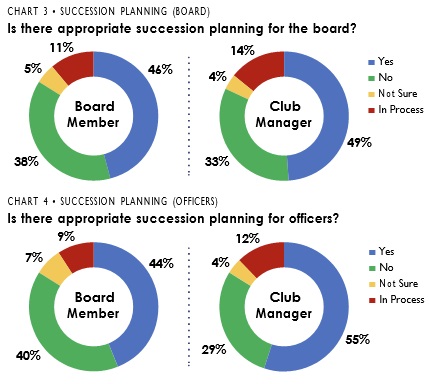

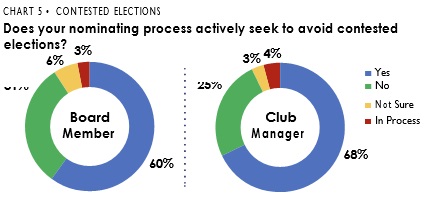

The Governance Survey addresses the first piece of the formula— getting the right people involved—through questions related to the nominating process, succession planning and the avoidance of contested elections. Contested elections are antithetical to effective succession planning for board members and officers, and therefore, the continuity of thought and implementation of plans across multiple administrations.

We concur with the many survey respondents who believe meaningful committee experience is an important prerequisite for board service. The critical resources used by effective boards start with fact-based education on the private club business model, which leads to including strategic plans, reserve studies, campus master plans, independent membership surveys and funded, long-term, integrated financial plans. In our opinion, the latter is the most important of all. It enables a club to match future resources with plans in a fiscally prudent manner.

Regarding focus, strategic boards should:

- Conduct annual orientations for new board members.

- Set annual agendas consistent with long-term plans.

- Fully fund long-term needs and avoid deferred spending on capital assets.

- Embrace the common key performance indicators that matter to every club to monitor performance.

Getting the right people involved is often the most challenging step to great governance. Succession planning for committees, boards and officers is critical but difficult to accomplish in the private club environment. A diligent and consistent approach is equally critical but elusive.

The following charts are a sampling of the results from our most survey. Succession planning is an issue for most clubs.

People

As illustrated in charts 1 and 2 below, most board members and club managers surveyed believe their clubs have an effective nominating process for board members and officers. The nominating committee is widely recognized as the most important committee in a club, due to its potential to affect the club’s success.

The effectiveness of succession planning (charts 3 and 4) is viewed much less favorably. Succession planning requires consistent attention and improvement, but it is critical to continuity of thought and implementation of plans. It is also extremely important for club managers who need to work with new officers and directors every year or two.

In survey comments related to the nominating process and succession planning, suggestions for improvement from board members and club managers include multi-year views by the nominating committee, a stronger statement of purpose of the nominating committee, a more formalized and transparent process, better education of candidates and mandatory committee experience.

While current bylaws and statutory requirements may limit the ability to avoid contested elections completely, they are a major impediment to purposeful board construction. Based on survey comments and our own experience as board members, board educators and advisors, many clubs are being more specific in their definitions of a slate (one candidate for each open position) as they rewrite their bylaws. Concerns of popularity contests and group self-perpetuation are better dealt with in the thoughtful construction of the nominating committee, more transparency in the committee process, and more education of the membership through board and committee communications.

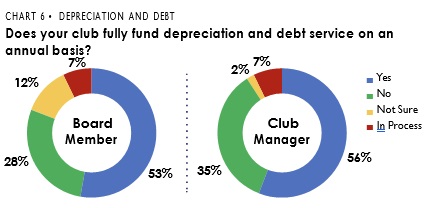

Private clubs are capital-intensive, high fixed-cost businesses. As such, there is little margin for error in simultaneously funding current-year operations and covering the club’s long-term capital needs. Club leaders must view and respect the independent funding of operating and capital accounts. Without careful consideration, the line is too easily blurred. While the capital fund is more important to the club’s long-term success, it is the one that often ends up underfunded. The near-term needs of operations or the unrelenting demands of debt repayment temporarily distract club leaders from the club’s longer-term goals. Good governance requires a thoughtful understanding and consistent approach to simultaneously managing the club’s short-term (operating) and long-term (capital) needs.

What is most interesting, and the most compelling for additional education, is how often survey responses do not align with the data we have available through our database or through publicly available Form 990s, audited financial statements, information from general managers and capital reserve studies.

At a minimum, we look to see if clubs generate net available capital equal to current year depreciation plus debt service. While many club leaders indicate in the survey that their flows are sufficient, the data from their clubs show a shortfall in funding. In addition, many club leaders are not sure of capital sufficiency, which is indicative of another weakness in club governance. There is a knowledge gap. At best, only about 50% of respondents in the 2021 survey were confident their club generated sufficient funding to cover depreciation and debt service on an annual basis. That should be a major concern to all involved.

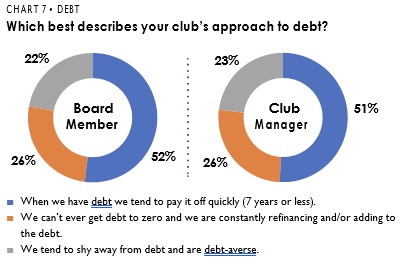

The survey also probes the use of debt and there, too, we find that club leaders’ responses often conflict with readily available financial data. The footnotes of audited financial statements are particularly enlightening on this topic. Through our board orientations and the examination of available data, we have revealed many misunderstandings around how the club has approached the use of debt. Examples include knowledge gaps related to refinancing, amortization periods and balloon payments.

Good governance requires the development of a fully funded long term plan that considers the lumpy financial needs of a strategic plan, a campus master plan, a capital reserve study and the effect of campus changes on operating costs. To be fully funded, a club must program the capital inflows that meet or exceed the timing and magnitude of needs for both obligatory and aspirational capital plans. If debt is to be used, it should be carefully planned. Frequent refinancing of debt should be a warning sign of weaknesses in capital planning. All club leaders should be mindful of debt being a member assessment spread over time.

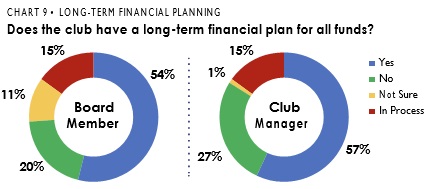

Funded or not, too few clubs have long-term plans for their operating and capital funds. Without long-term visibility, it is impossible to set fees, establish adequate reserves and govern effectively. The knowledge gap exists, at least to some degree, in every club. It is an issue perpetuated by the regular turnover of board members and members at large. At the board level, bridging the gap begins with an honest, fact-based evaluation of understanding and alignment around the fundamentals of club finance. That process can be challenging, but recognizing the issues is the first step. As that gap closes at the board level, the leadership team will be better positioned to inform and educate the membership. While there are certainly those who will never be swayed by facts, we have witnessed some remarkable conversions, . where staunch skeptics or those who simply don’t know what they don’t know have come to embrace the data and join in the effort to move the club forward.