Situational Awareness

The House is not in session this week as House Republicans will be in Ponte Vedra, Fla., for their annual three-day issuThe House returns from a brief recess period to allow for the Republican Policy Retreat and will consider legislation decriminalizing and taxing marijuana and cannabis products. The Senate is in session and will continue consideration of legislation boosting manufacturing in the U.S.

President’s Budget Released this Week

President Biden is set to release his proposed budget for fiscal year 2023 (FY 23) this week. The budget covering Oct. 1, 2022 through Sept. 30, 2023 is expected to contain $813.3 billion in national security spending, including $773 billion for the Pentagon. This level of spending represents an increase of roughly $31 billion over current spending. The proposal is also expected to include a new 20% tax on the income and unrealized capital gains on households worth more than $100 million. House and Senate Committees begin hearings on the President’s budget this week.

Marijuana Legislation Up This Week

The House is likely to consider legislation this week that would decriminalize and tax marijuana and cannabis products. The bill would retroactively wipe away previous marijuana convictions and do away with pending cases. It would also impose taxes on producers and importers and pressure states to enact similar changes by conditioning their eligibility for federal grants. The National Club Association (NCA) has been tracking this issue in the House and Senate and previously reported the issue has been cited as a priority for Senate Majority Leader Chuck Schumer (D-N.Y.). Schumer has said he would like the Senate to consider decriminalization in the Senate sometime this spring.

OSHA Injury and Illness Reporting Proposed Rule

The White House Office of Information and Regulatory Affairs (OIRA) completed review of an Occupational Safety and Health Administration (OSHA) proposed rule last week that would restore provisions of an injury reporting rule adopted by the Obama Administration in May of 2016 that were removed by the Trump Administration in 2019. The review by OIRA allows OSHA to proceed with publication of a proposed rule. A pre-publication notice was released Monday morning and the rule is expected to be published on Wednesday. NCA will review the proposed rule and likely draft comments.

House Retirement Bill Up Wednesday

On Wednesday, the House is scheduled to take up retirement legislation under the suspension calendar. The suspension calendar allows the House to consider legislation with limited debate, but requires a two-thirds vote to pass rather than the simple majority. The legislation would increase the age individuals must start drawing on their retirement accounts to 75 in 2033. It would also allow employers to make matching contributions to retirement accounts based on employee student loan payments and expand tax incentives for small businesses to create retirement plans. The legislation, H.R. 2954, is a bipartisan bill that includes provisions from both the Ways and Means Committee and House Education and Labor Committee.

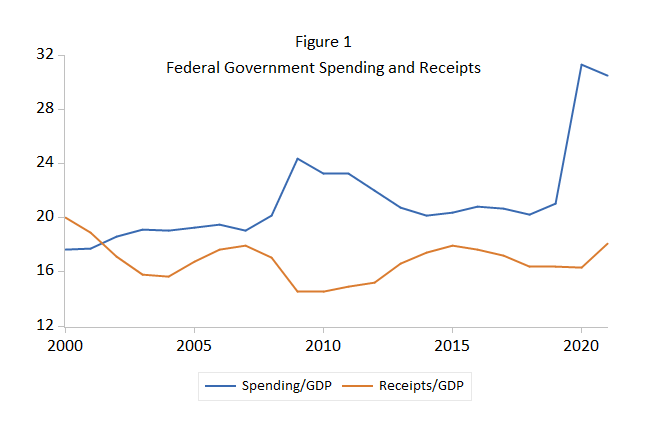

Potential Consequences of Government Spending and Inflation

In a recent article on the American Institute for Economic Research website entitled Government Debt and Inflation: Reality Intrudes, Gerald P. Dwyer, professor and BB&T Scholar at Clemson University, raises a concerning issue that may be developing slowly, but surely before our eyes. For well more than a decade, the Federal Reserve has been able to maintain an accommodative interest rate because inflation didn’t seem to be much of a problem. With $6 trillion in government spending and a doubling of the Fed balance sheet in a span of 18 months, coupled with supply chain issues amidst burgeoning demand, we’ve seen inflation balloon to rates we haven’t seen since 1982. What are the potential consequences of raising interest rates to a level needed to tame inflation? In particular, what does it mean when interest rates on publicly held debt increases?

“What will happen when average interest rates on public debt increase? Holders of public debt today at 1.8% are losing on average more than 5% of the purchasing power of their funds in a year. An average interest rate of 5% on public debt suggests interest payments equal to 35% of current federal government revenue. This interest rate is hardly an attractive proposition though. At an interest rate of 5 percentage points, anyone holding public debt at current inflation rates still would be losing 2% a year in purchasing power. An average interest rate of 7%, high relative to recent interest rates but not high relative to recent inflation rates, would require 50% of the government’s revenue.”

“Sooner or later, absent substantially lowering government spending or raising taxes, interest payments will overwhelm the government’s budget. The situation might even be termed a sovereign debt crisis because all the spending, revenue, deficit and inflation choices are unpalatable.”

NCA has a New Home in Alexandria, Va.

The National Club Association has moved our headquarters to Alexandria, Va., to provide better work-life balance for staff and better serve our members, while continuing to conduct our critical advocacy work with legislative and regulatory leaders in Washington, D.C.

The new office offers increased opportunities for staff to collaborate whether we work there or in our home offices. Our new address is 1680 Duke Street, Suite 420, Alexandria, Va., 22314. Read our press release on the move here.