Much attention has been placed on women and the continuously emerging and evolving role they have in the workplace, home and society. As societal norms and policies change, generating greater influence and opportunities for women, clubs must pay attention to key trends impacting the counterparts of the often-considered traditional member.

Women in the Workforce

Women make up 47% of the overall labor force; however, they represent 50.2% of the college educated workforce—up from 45.1% in 2000, reports Pew Research Center. According to the U.S. Census Bureau, women-led households make up 30.5% of all households, up from 26% in 1980. Women’s income is up as well, as their earnings have grown by 75% from 1970 to 2015, compared to just 5% for men. However, women’s collective pay represents roughly 77 cent per dollar earned for men, and when comparing the same job, multiple studies show that women are paid less than man ranging from percentages in the 80s and 90s.

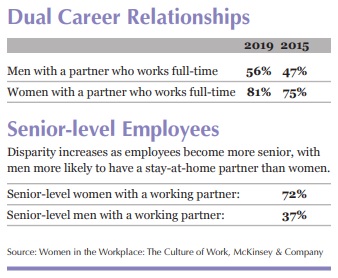

This shift in representation and societal norms are being reflected in workplace policy as parental leave coverage has risen from 24% in 2015 to 40% in 2018, according to Mercer’s Women in the Workplace study. According to Women in the Workplace: The Culture of Work, a 2019 study by McKinsey & Company, most companies give employees work-life flexibility. However, 20% of women who have taken leave as a new parent or to deal with a significant personal or family health issue, say it negatively impacted their career, compared to 10% of men. Women are also twice as likely to say it had a negative effect on their financial well-being.

Box

Higher Education

According to data from the U.S. Department of Education, for the tenth consecutive year, women earned more bachelor’s, master’s and doctorate degrees than did men.

In 2018, 57% of college graduates and 59% of master’s students were women.

The (Other) Income Gap

Although women’s role in the workplace has grown, their lifestyles and demands on them often pull them out of the workforce, creating a wealth gap compared to men when it comes to retirement. Eighty percent of women have children, reports the Centers for Disease Control. Women with children often receive less pay than non-mothers due to lost income, occupation and opportunities forgone from not being in the workplace. After returning to the workplace, many new mothers take less-demanding jobs that pay less. Later in life, women are more likely to care for elderly adults including parents and relatives, and, later in life, their spouses. Caregivers also spend roughly $7,000 annually on the care recipient, reports AARP, resulting in less long-term savings.

Women also retire earlier and live longer compared to men, placing a heavier burden on them to save money. With work interruptions like childrearing and caregiving, women generally have less money saved for their golden years. On average, women spend 44% of their adult life out of the workforce compared to 28% of men, according to the Bureau of Labor Statistics. In all, retiring women earned roughly $1,055,000 less than men who continuously worked.

Senior-level Employees

Disparity increases as employees become more senior, with men more likely to have a stay-at-home partner than women.

Senior-level women with a working partner: 72%

Senior-level men with a working partner: 37%

Source: Women in the Workplace: The Culture of Work, McKinsey & Company

Women in Leadership

Since 2015, the number of women in senior leadership has grown. This is particularly true in the C-suite, where the representation of women has increased from 17 percent to 21 percent, reports McKinsey & Company’s “Women in the Workplace” 2019 study. New data also suggests that women may have advantages over men in regard to leadership. According to a recent study, “The XX Factor: The Strategic Benefits of Women in Leadership,” female-led businesses (companies with more than 50% female representation in management) are better perceived by employees in how they rate the effectiveness of their leaders.

The study also showed that employees believe more strongly in the strategy set by senior leadership at women-led companies. Factors that contribute to strategy, like communication and mission were also rated more highly at these businesses. Other measured categories like engagement and meaningful work, show men- and women-led companies rated similarly. Men-led companies rated higher in growth and goal setting. While the study shows a correlation between how gender-led organizations are perceived, the study presents key insights to male and female leadership.

Deloitte’s 2019 Women in the Boardroom report found that 17.6% of board seats in the U.S. were occupied by women last year, which ranks roughly in the middle of the 66-country study. This figure is up from 14.2% in 2016 and 12.2% in 2014. American board chairs are just 4.4% women. Women served 6.3 years on the board in 2018 compared to 9 years for men. When women serve as CEO or board chair, the company’s board averages more female representation.

Companies with Female CEOs (worldwide)

29.3% female board

Companies with Male CEOs (worldwide)

16.5% female board

Companies with Female Board Chairs (worldwide)

28.3% female board

Companies with Male Board Chairs (worldwide)

17.1% female board

The study also identified California and Illinois as the only states that have quotas for women serving on the board of public companies. Maryland, Massachusetts, New Jersey, Pennsylvania and Washington have introduced similar legislation.

Affluent Women

Nearly half (48%) of U.S. millionaires are women, reports Dimensional Fund Advisors and 51% of the country’s wealth is controlled by women. By 2029, Dimensional estimates that women will influence 75% of all discretionary spending. The Economist Intelligence Unit estimates that women will control $72 trillion (32% of all wealth) in the U.S. by 2020, up from $51 trillion in 2015.

The Economist Intelligence Unit also conducted a survey that found that high-net-worth men (those with more than $1 million in assets) vastly outnumber high-net-worth women; however, that number is more even (27% men and 22% women) when comparing individuals with more than $5 million in assets.

Younger generations of women also have more control of their household’s finances. Most affluent millennial women (72%) are becoming their household’s primary financial planner. However, among female baby boomers, that number is less than half. More millennial women than their boomer counterparts are the primary decision makers when it comes to household purchases, day-to-day banking and charitable giving.

The study also found that affluent women emphasize their charitable giving based on the biggest impact it will make. Men, on the other hand, generally direct their charitable giving based on tax benefits. This is also reflected in women-owned businesses as women, more so than men, believe their companies should make both a positive economic and charitable impact on their communities.

Women, in general, prioritize their families when it comes to money. According to the 2017 U.S. Trust Insights on Wealth and Worth survey, 77% of women view money in terms of what it can do for their families. In regard to investing, 65% of women say they want to invest in causes that matter to them, and 52% of women investors are interested in or currently engaged in impact investing, generating financial returns along with social returns, compared to 41% of men.

Marketing to Women: Provide Great Experiences

Bridget Brennan, CEO of the consulting firm Female Factor, says the customer experience is critical to staying relevant in women’s eyes for both online and real-world shopping. Despite the impersonal nature of e-commerce, some women find the online buying experience to be higher quality than face-to-face purchasing. Brennan explains that in retail stores, service may be unhelpful or unavailable and products may be out of stock, whereas online shopping eliminates many of these possibilities. She notes that retail stores can enhance their experiences by creating sensory engagement and by improving employee recommendations and expertise.

Brennan proposes three ideas to improve the customer experience for women:

- Appeal to holistic buyers. Enhance the experience beyond product and price by improving the in-store experience, employee expertise and engagement after purchase.

- Reverse-engineer the experience to drive positive emotional outcomes. Customers’ emotions draw them to buy from specific stores and brands. Understand their motivations.

- Build an inclusive approach. Adapt language, attitudes and social roles involving women to stay relevant in today’s business world. Remove stereotypes from marketing materials and customer service practices.

Women-only Spaces

Globally, more spaces are sprouting that cater to women only. Som Dona is a hotel for women in Spain that offers a relaxing experiencing off the Mediterranean. Som Hotels CEO Joan Capellà said the concept arose from the growing trend of hospitality industries catering to just women. He said that Som’s research found that women seek “wanderlust destinations and are driven by healthy lifestyle habits while socializing with other women.” The hotel is designed with women in mind, with room décor, including the color palette, pool and restaurant all geared to help women relax and socialize.

Other properties are jumping in on the trend, offering entire hotels or floors to women. These areas are often staffed by just women and are equipped with features catering to women like additional safety measures, jewelry boxes, yoga mats, makeup kits, and even a “kiss cam” for calling loved ones.

While American laws and regulations prevent gender discrimination in places of public accommodation, there is a growing trend in the hospitality industry globally and domestically to offer female friendly spaces that provide a safe and enriching place for women to relax and enjoy each other’s company.

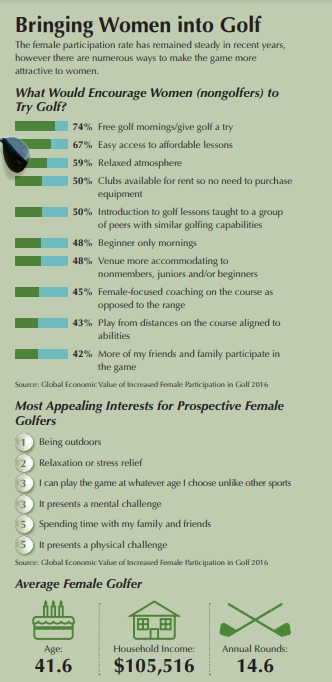

Women in Golf

In 2018, 5.7 million of the 24.2 million individuals who played golf were women, representing roughly 23% of all golfers, reports the National Golf Foundation. Women also represent a higher percentage of beginners (31%), juniors (36%) and off-course participants (44%) than they do in the general golf population (23%).