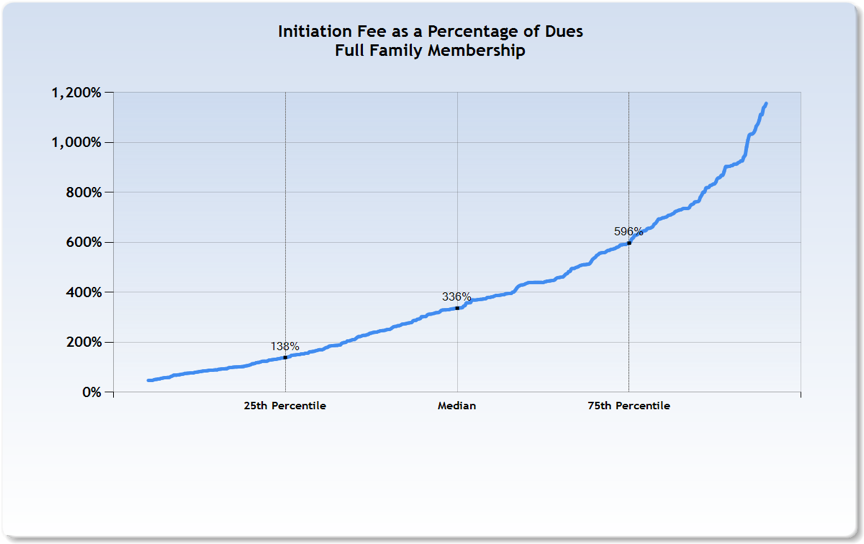

A marker of the value proposition in a club is the ratio of “Initiation Fee to Annual Dues.” Clubs with a relatively high ratio deliver a value proposition in which incoming members are willing to invest the equivalent of many years dues on the front end in order to join the club. Their motivation to join is high and they willingly make a longer term financial commitment to the club.

A marker of the value proposition in a club is the ratio of “Initiation Fee to Annual Dues.” Clubs with a relatively high ratio deliver a value proposition in which incoming members are willing to invest the equivalent of many years dues on the front end in order to join the club. Their motivation to join is high and they willingly make a longer term financial commitment to the club.

On the other end of the spectrum are clubs with a low initiation fee relative to the cost of annual dues for a full membership. Twenty percent of clubs have an initiation fee equivalent to less than one year of dues. For clubs with a low initiation fee to dues ratio, the commitment of a member joining is low and not long term. Their motivation is lower, and they are clearly making a much shorter term financial commitment.

Club Benchmarking data shows that clubs with a high initiation fee ratio tend to be capital rich, meaning they have the money necessary to continuously invest in facilities and new amenities. Clubs with a low ratio tend to be capital starved and lack the necessary capital to invest. Without adequate capital investment, a club’s physical plant deteriorates, and it becomes increasingly difficult to attract and retain members. This catch-22 situation can be devastating if not addressed and corrected.

The key is to understand one essential fact: A club’s value proposition is tied to the money invested in the club. The more money invested, the higher and more compelling the value proposition. The ratio of initiation fee to dues reflects the club’s value proposition at a given point in time, and also directly reflects a club’s capital resources. Clubs with low ratios are focusing on price, not on delivering value to current and future members.