Situational Awareness

After departing Capitol Hill early last week after passing a short-term FAA reauthorization extension and blocking a motion to vacate Speaker of the House Mike Johnson (R-La.), the House returns to vote this week on several bills dealing with consumer safety and border control. Legislation set to be considered by lawmakers includes the No Hidden FEES Act of 2023, which would require providers of short-term lodging to display mandatory fees that are required to complete a booking. In the Senate, lawmakers passed both the FAA stopgap bill and their own sweeping five-year reauthorization package. The House is expected to take up the measure upon their return.

Congressional Debate on Extending 2017 Tax Cuts Heats Up

GOP lawmakers on the House Ways and Means Committee—the top tax-writing body in Congress—have increasingly begun to publicly debate either maintaining or minimally reversing tax cuts included in the Tax Cuts and Jobs Act of 2017 if they maintain control over the House after the 2024 elections. According to reporting by Bloomberg, Chairman Jason Smith (R-Mo.) expressed a preference to raise the corporate tax rate, which was reduced from 35% to 21% in 2017. With a bipartisan tax package seemingly out of reach for the remainder of the current legislative session, members will examine ways to offset a future package’s costs as well as a resolution to the state-and-local tax deduction cap.

The optimistic outlook from House Republican members was dampened following the release of a new report from the Congressional Budget Office (CBO) last week that found extending the 2017 tax cuts could add $3.3 trillion of dollars to the U.S. deficit over the next decade. In a statement released by the Senate Budget Committee, Chairman Sheldon Whitehouse (D-R.I.) suggested the CBO’s report should encourage lawmakers to “undo the damage” caused by the 2017 package as well as “fix our corrupted tax code, and have big corporations and the ultra-wealthy begin to pay their fair share.”

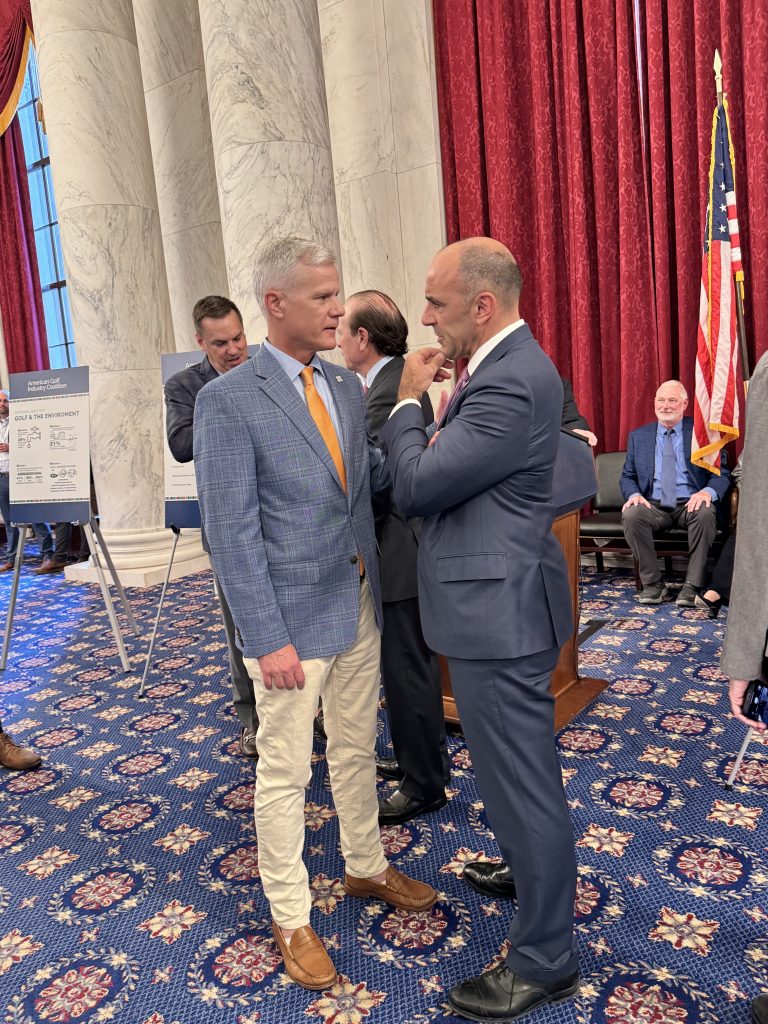

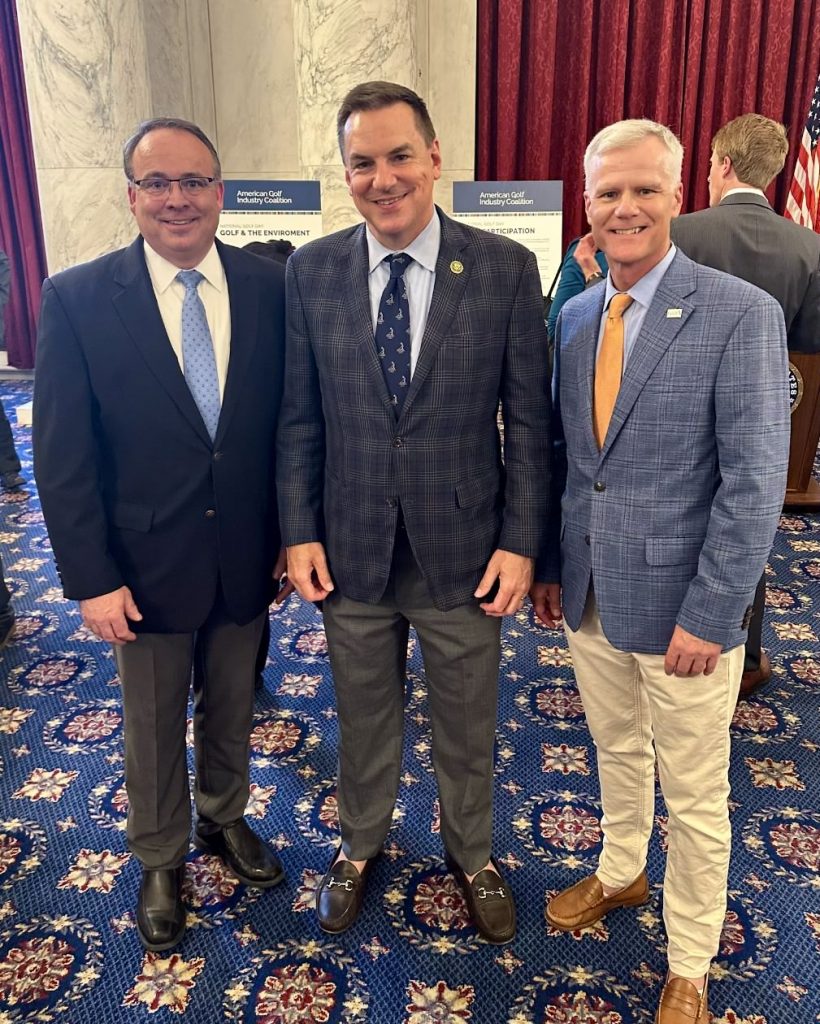

National Golf Day

NCA participated in National Golf Day last week supporting the American Golf Industry Coalition. NCA President & CEO Joe Trauger met with members of the Virginia congressional delegation and had the opportunity to reconnect with Congressman Jimmy Panetta (D-Calif.), pictured right. ClubPAC supported Panetta, co-chair of the Congressional Golf Caucus, and visited with him in his district last month. You can read our interview with him in the new Club Director. Congressman Richard Hudson (R-N.C.) is also co-chair of the Golf Caucus. His district is the home of Pinehurst, the site of the 2024 U.S. Open. Pictured below are Congressman Hudson (middle) and NCA member David Dew of Forest Creek Golf Club (left), also in the Congressman’s district.

Businesses Request More Time to Comply with DOL Overtime Rule

A group of 88 business groups sent a letter to the Department of Labor’s (DOL) Wage and Hour Division (WHD) requesting more time to comply with the agency’s final rule that would expand overtime protections to workers making less than $58,656—a significant bump from the current level of $35,568. The letter warns that the current effective date of July 1 is too soon for businesses to “analyze the rule, determine what changes to their operations and payrolls will be necessary, explain to the impacted workers how and why their pay, titles, or workplace responsibilities will change, and then implement those changes.”

During a Senate Appropriations Committee hearing last week with Acting Secretary Julie Su, Republican lawmakers raised concerns about the final rule’s timeline for compliance and its impact on businesses’ operating costs. In response, Acting Secretary Su explained that the overtime rule would bump up the threshold on July 1, and full compliance will be required in January. She also detailed how the rule’s formula takes cost of living concerns into account for the implementation of the rule, providing further flexibility for employers.

DOJ Files Brief in North Carolina WOTUS Lawsuit

The Department of Justice submitted a May 7 motion to the judge assigned to a lawsuit from North Carolina property owner Robert D. White against the Environmental Protection Agency and the U.S. Army Corps of Engineers on their implementation of a conforming rule defining federally protected waters. The lawsuit argues that EPA has ignored the Supreme Court’s ruling that wetlands qualify for federal protections if they are relatively permanent and are “indistinguishable” from larger navigable waters because there must be a “continuous surface connection” between the two. In its filing, the DOJ hold the position that the river and the wetlands specific to White’s case just need to touch, or “abut,” to qualify for federal protections. A physical—not hydrological—connection between larger waters and wetland is all it takes, the department said.

House Ed and Workforce Committee Report Released NLRB Mail Ballot Report

Last week, Education and the Workforce Committee Chairwoman Virginia Foxx (R-NC) released a committee staff report detailing the National Labor Relations Board’s (NLRB) misconduct and procedural irregularities related to its administration of mail ballot elections. In November 2020, NLRB issued a decision that expanded regional directors’ authority to order an election by mail rather than in-person, secret ballots. The committee’s report is based on findings from thousands of pages provided by NLRB on the administration of mail ballots.

New Webcast: Crafting a Distinctive Identity for Your Club

Join NCA on Thursday, May 16 at 2pm ET to learn how architectural and interior design brand guidelines affect club environments and the benefits of a well-defined identity for your club to help retain and attract new members. Register here.

Read the New Club Director: Keeping Employees for the Long Term

NCA recently published the new Club Director, which includes The State of NCA, written by Joe Trauger, and three staffing solutions articles on staff longevity, hiring in today’s climate and employee engagement. Read these and other stories here.