Objectivity is a key component of effective decision making no matter what business you are in. Great businesses and the people who run them rely on facts—they don’t guess. Would you visit a doctor who doesn’t use blood tests, MRIs, EKGs and the like to look for answers and diagnose a serious illness? Would you hire an investment manager who doesn’t rely on facts and data to evaluate companies in terms of their financial and operational health, and market valuations, or one who makes investment decisions without due diligence?

Through continuous analysis, patterns emerge from data and research that produce the following fundamental concepts of club finance:

- The clubs with the highest dues and initiation fees have the most members and the clubs with the lowest dues and initiation fees have the fewest members.

- The clubs that have higher operating expense per member are healthier than clubs with lower operating expense per member.

- The healthiest clubs from a finance perspective typically have greater deficits in F&B than clubs that are financially weaker.

While most of the money (85% over time) at the average club flows through the operating ledger, the operating ledger is not the financial driver. The operating ledger’s purpose is to deliver services and amenities to members, aka the member experience. Operating monies are, by definition, consumed operating the club. The financial driver of the club is the capital ledger. Capital income and capital investment affect the club’s financial outcome over time. Data shows that 40% of clubs have a lower net worth (book value) today than they did in 2006 due to inadequate capital income over time.

In combination, those four statements lead to a decisive conclusion regarding appropriate business strategy in a private club: Clubs do not compete on the price they charge. They compete on the member experience they offer.

The goal of this issue of Club Business is to address the negative impact of an IKB (I Know Better) mindset on the club’s financial outcomes which is directly related to misunderstanding (or outright rejection) of the fact-based conclusion above. You can probably identify a few IKBs within your own club’s membership and our objective is to arm you with the facts you need to counter their negative impact. If you recognize some traces of the IKB mindset in yourself, we encourage you to stay with us. Reading this issue thoroughly and with an open mind could be of great benefit to your club and your fellow members. IKB syndrome is most prevalent among tenured, older golf-centric members (“give me good golf and to hell with the rest”). They dislike and perhaps resent being asked to invest, and when they do invest,

they contribute as little as possible. They are inclined to reject data and facts in favor of laser focus on dollars and cents, but the data shows that their theories on the club business model are faulty.

Data confirms that a club’s competitive advantage, or disadvantage, is the quality of the member experience. Quality—not price—makes one club more desirable than another and allows that club to command higher initiation fees and higher dues than others in the same market.

The IKBs’ focus on money seems to be grounded in the strongly held belief that clubs compete on price. If that were true, then perhaps their insistence on cutting costs, keeping dues low and minimizing or eliminating any deficit in the food and beverage department would make sense, but it’s not true. Analysis of financial and operational data from 1,000+ clubs over more than a decade has proven that clubs do not compete on the price of the member experience. They compete on the quality of the member experience. Ironically, the IKBs’ inclination to cut costs, keep dues low and avoid capital investment is actually the most certain way to destroy the quality of the member experience and set the club’s value proposition on a downward spiral.

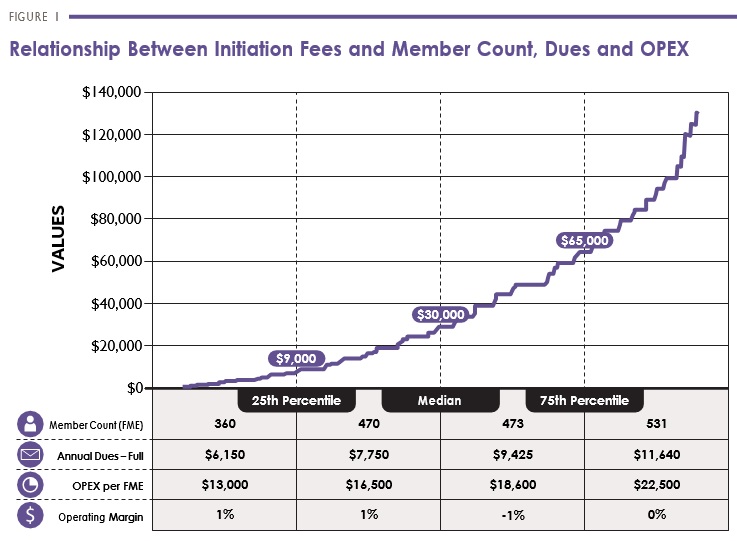

Figure 1, below, presents the distribution of initiation fees. The data is pre-pandemic to show the “steady state” business model without government assistance. The chart presents data for 869 clubs with golf, but the same pattern exists in clubs without golf.

The initiation fee is a clear, objective, quantitative measure of a club’s competitive market position. Clubs with higher initiation fees have greater demand for entrance than slots available. Clubs with lower initiation fees have more slots available for membership than they have members desiring to join. The data in Figure 1 presents the median value for each of the metrics in each of the given quartiles of initiation fee distribution (approximately 200 clubs per quartile).

Figure 1 is a data-driven, fact-based manifestation of the private club business model. As the initiation fee increases, so too do the member count and the operating expense per member. Clubs with the highest initiation fees have the highest expense per member and the most members. Clubs with the lowest initiation fees have the lowest expense per member and the least members. The majority of private clubs in the U.S. hold 501(c)7 not-for-profit tax status. As such, they purposefully set their operating ledgers to break-even in the budgeting process and, per the data, that is where they end up.

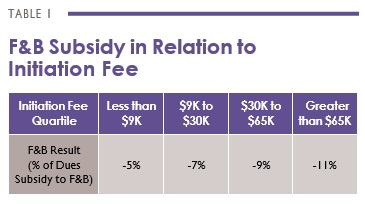

Table 1 above shows the variation in F&B financial results for each of the four quartiles. Clubs with higher initiation fees subsidize F&B more than clubs with lower initiation fees. They aim to treat F&B as they do any other amenity that is part of the member experience. For the record, the amenity that has the greatest deficit is golf—at the industry median, it garners 33% of the dues as a subsidy for that department. While the IKB crowd is constantly harping on the deficit in F&B, they are uncharacteris- tically silent about the deficit in golf. It is a complete misunderstanding of the business model due to the lack of data.

Applying the Fundamental Concepts

The four statements laid out at the beginning of this article comprise the fundamentals of the private club business model. Let’s look at how those four fundamental concepts can be applied to a specific club.

- When making decisions about annual dues increases, lean toward ensuring the dues properly fund a compelling member experience. Don’t succumb to pressure from IKBs arguing that “we will price ourselves out of the market.” The data shows clubs with higher dues have more members than clubs with lower dues. The tradeoff on the margin should be incrementally higher dues to deliver a better experience, not incrementally lower dues to keep the cost of belonging low.

- The club business model does not center on the notion of keeping expenses low. It centers on effectively delivering a compelling member experience. Higher expenses reflect a more compelling member experience in terms of breadth of services and amenities delivered with great service. They don’t automatically mean the club is wasting money. Remember, clubs compete on the experience they offer, not the price they charge.

- F&B is an amenity just like every other amenity the club offers. It is the most important amenity in terms of its effect on overall member satisfaction. F&B is not a profit center. F&B in a private club is not the same as a restaurant. Commercial restaurants have a different business model and they are in a different industry. Private club F&B operating costs must be covered either through margin on F&B revenue or by a dues subsidy. When more of the costs are covered with a dues subsidy, those costs are spread more equally across the membership. When the balance is toward covering the costs through margin, heavier users of F&B are disproportionately covering the costs. Margin involves pricing and quality decisions. More margin means higher prices and possibly lower quality. Certain clubs have made the decision to keep prices low and quality high and thus lose money in F&B. They are not inefficient; they are making a strategic choice that drives member satisfaction. In the end, the members are paying for the costs of F&B either out of their dues pocket or out of their per-use-fees pocket. That is the choice that explains the variation in F&B financial results across the industry. Healthy clubs lean more towards covering F&B costs through dues (lower prices, higher quality) than through margin (higher prices, lower quality).

- If you are worried about the quality of your club’s member experience, focus on the operating ledger to ensure there is adequate dues revenue to fund a compelling member experience. If you are worried about your club’s finances, focus on the capital ledger to ensure there is adequate capital income to reinvest in your assets consistently over time. Lack of adequate capital income and investment results in long-term deterioration of the club’s physical assets and thus deterioration of the member experience.

The power of IKBs to distract clubs from data-driven, fact-based leadership is unfortunate, but it is very real. I hope the insights you gain by reading this issue will empower you to help counter their negative, weakening impact and drive the club forward to success.