The Club Leadership Alliance (CLA), co-founded by McMahon Group, Kopplin Kuebler & Wallace and Club Benchmarking, has a vision for the industry of transforming the club leadership model through widespread understanding and adoption of the best practices that lead to sustained club success. Those best practices fall into four categories, which have been adopted as CLA’s core values:

- Informed Leadership

- Strategic Stewardship

- Empowered Management and Team

- Compelling Member Experience

While all four of these core values are relevant to a discussion about club facilities and their role in energizing and driving membership, we will focus on Strategic Stewardship and one of its associated best practices.

BEST PRACTICE

Protect, preserve and grow the club’s assets through comprehensive capital planning that addresses obligatory and aspirational improvements within a unified facilities master plan.

The call for club leaders to protect, preserve and grow the club’s assets is no small undertaking. With extensive campuses, large physical plants and a vast inventory of equipment, clubs are voracious consumers of capital. In order to remain healthy and relevant over time, a club’s capital investments must address both obligatory capital used for ongoing repair and replacement of existing assets, and aspirational capital that supports new, forward-looking projects and acquisitions. Vibrant, attractive club facilities that drive membership are the result of consistent and continuous capital investment on both fronts. An effective facilities master plan must take both types of capital investment into consideration to help clubs make the right investments at the right time for maximum impact on their power to attract and retain members.

Unfortunately, efforts to get capital flowing in the right direction are often disrupted by the natural friction that exists in the club environment. Data captured through club member surveys reveals a common thread of tension between long-tenured members happy with the status quo and newer members with an appetite for change and improvements. As the saying goes, “nothing in life is as constant as change,” but the reality is that many clubs struggle to accept, embrace and plan for it.

Club Benchmarking analysis of industry data shows clubs that embrace change and invest consistently in their physical plant have higher initiation fees and full membership rosters. Resistance to change, manifested through insufficient or inconsistent capital investment, leads to dilapidated, rundown facilities that fail to attract younger prospective members, who are the future of every club. For perspective on the demographic to which your club needs to appeal, consider that the average age of members joining a club is 42.

Another common momentum-killer for clubs is a startand- stop approach to facilities planning and capital investment. When a major project concludes, it is natural to feel some relief, but dangerous to equate that sense of accomplishment with being “done.” Forward-looking capital planning is an essential element of sustainable financial success and membership growth. It must be embraced as a continuous process focused on ensuring funding of a long-term plan versus funding an individual project.

KNOW WHERE YOU STAND

There are two central tenets of club finance that will serve as a foundation for our discussion about capital planning and investment.

The operating ledger or income statement is not a club’s financial driver. The majority of private clubs (90%) set the income statement to break-even excluding depreciation (which is considered a capital expense). Simply put, the money used to operate a club is fully consumed over the course of the year by members enjoying the club.

A club’s financial driver over time is capital income which fuels the capital investment engine to assure enough capital to re-invest in the assets it already owns (obligatory capital investment) and add to its asset base (aspirational capital investment). Two-thirds of clubs are not generating enough capital to fund both their obligatory and aspirational needs.

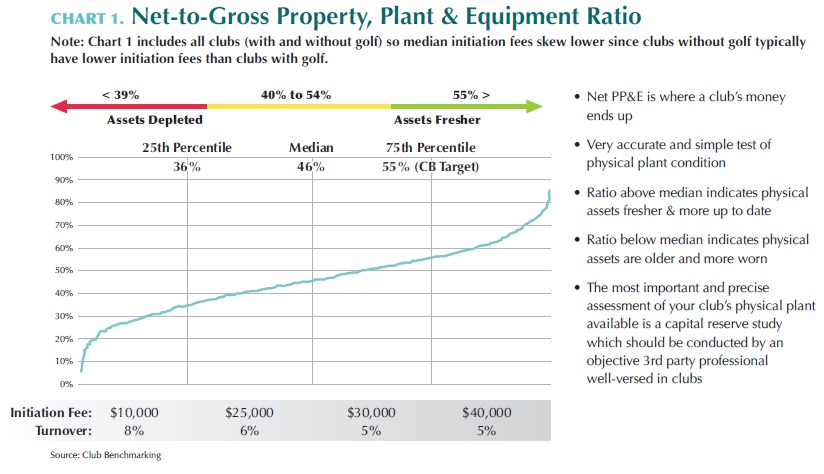

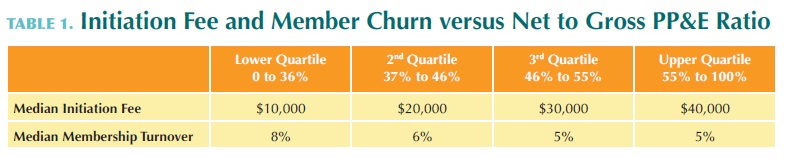

Club Benchmarking research has identified a Key Performance Indicator that clearly illuminates the state of a club’s assets: Net-to-Gross Property, Plant & Equipment ratio (PP&E). The calculation is Net PP&E divided by Gross PP&E with the value of nondepreciating land subtracted from both Gross and Net prior to doing the calculation. Chart 1 below shows the distribution of Net to Gross ratios from more than 800 clubs.

As Chart 1 shows, there are clear variations in initiation fees and membership turnover relative to the ratio that suggest that the state of a club’s facilities has a direct impact on the membership experience. Our observations over the course of hundreds of onsite visits confirm that clubs with Net-to-Gross PP&E ratios in the lower quartile usually have facilities, fixtures and equipment that are obviously depleted to the naked eye while clubs in the upper quartile typically look fresh and up to date.

That variation speaks to the club’s value proposition as experienced by prospective members touring your club. The data shows higher initiation fees track to fresher assets as one would logically conclude. The data also shows that initiation fees tend to be significantly lower in clubs with more depleted assets. ($40,000 vs. $10,000).

significant when you consider that a club with 5% turnover (just below the industry median) would need to replace the entire membership every 20 years while a club with 8% turnover would need to replace its membership every 12 years.

APPLYING THE RATIO TO YOUR CLUB

Understanding and applying the Net-to-Gross PP&E ratio is a simple way to assess how your club has done attending to obligatory and aspirational capital needs over time. Club Benchmarking considers a ratio under 40% to be a red flag. Those clubs have significant deferred maintenance, often because of lack of vision and anemic capital. Clubs with a ratio over 55% get a green flag. Those clubs have assets with obvious curb appeal as a result of consistently evolving and investing in their long-term vision. A ratio between 40% and 54% is a yellow flag and indicates there is work to be done.

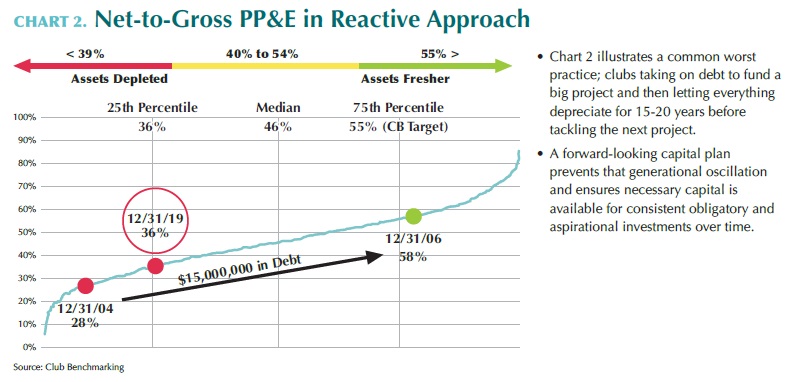

Each year a club’s Net-to-Gross PP&E ratio undergoes a tug-of-war where capital investment pushes it higher, and depreciation pulls it back in the other direction. The ratio will never be static, but a thoughtful, proactive unified master facilities plan coupled with a forward-looking capital plan will insulate your club from wide, generational swings.

Chart 2 shows what happens when clubs take a reactive approach to capital investment, tackling large projects every 20 years or so with funding for those projects often coming from debt and/or assessments. After a major project, the club takes a big breath and then sits back to rest, neglecting its obligatory capital requirements. The result is an inevitable decline in the state of its assets until another big project is deemed necessary and the cycle begins again.

Adoption of the best practice laid out at the beginning of this article has two requirements. The first is to establish a unified master facilities and campus plan that becomes the roadmap for obligatory and aspirational investments. Like a golf course master plan, the master facilities plan is a living document put in place to guide future decisions and investments. The existence of the plan assures continuity from one board to the next and lessens the likelihood that a “pet project” will derail the club’s progress down the road.

The second requirement is that unified master facilities and campus plan must be backed by a comprehensive, accurate, forward-looking capital plan that is funded by the membership to assure the club is aggregating the capital to meet its future obligatory and aspirational goals.

Developing a vision for what your club will become over the next decade or more is one of the most important tasks a board can undertake. Ensuring that vision becomes a reality for future generations requires both a facilities master plan and a funded long-range capital plan. That is strategic stewardship.